Binance Eyes Return To Tokenized Stock Trading

Binance is considering reviving tokenized stock trading after shutting the product down in 2021 amid regulatory scrutiny, as onchain equity interest grows.

Binance is considering reviving tokenized stock trading on its platform, nearly five years after shutting down a similar offering amid regulatory scrutiny.

The crypto exchange is weighing whether to reintroduce stock tokens, which are digital representations of shares in publicly traded companies that allow users to buy fractional exposure and settle trades on a blockchain. Binance previously offered tokenized shares tied to companies such as Tesla, Apple, Microsoft, Coinbase, and Strategy before discontinuing the product in mid-2021.

A Binance spokesperson confirmed the company is exploring tokenized equities as part of a broader push to bridge traditional finance and crypto.

“Since last year, we started supporting tokenized real-world assets, and we recently launched the first regulated TradFi perpetual contracts settled in stablecoin,” the spokesperson said. “Exploring the potential to offer tokenized equities is a natural next step in our mission to bring TradFi and crypto closer together.”

The renewed interest comes as exchanges and traditional financial institutions revisit tokenized securities, a category that has long faced legal and regulatory obstacles.

Binance first launched stock tokens in April 2021, but the offering quickly drew attention from regulators. Authorities in the United Kingdom and Germany questioned whether the tokens violated securities laws, prompting Binance to halt the product just a few months later.

Interest in tokenized stocks has resurfaced across the industry. OKX is also evaluating stock token products, according to comments from its global managing partner to The Information. In the United States, both the New York Stock Exchange and Nasdaq are seeking regulatory approval to launch similar offerings. Coinbase is also exploring ways to bring stocks onchain.

Tokenized Stocks By The Numbers

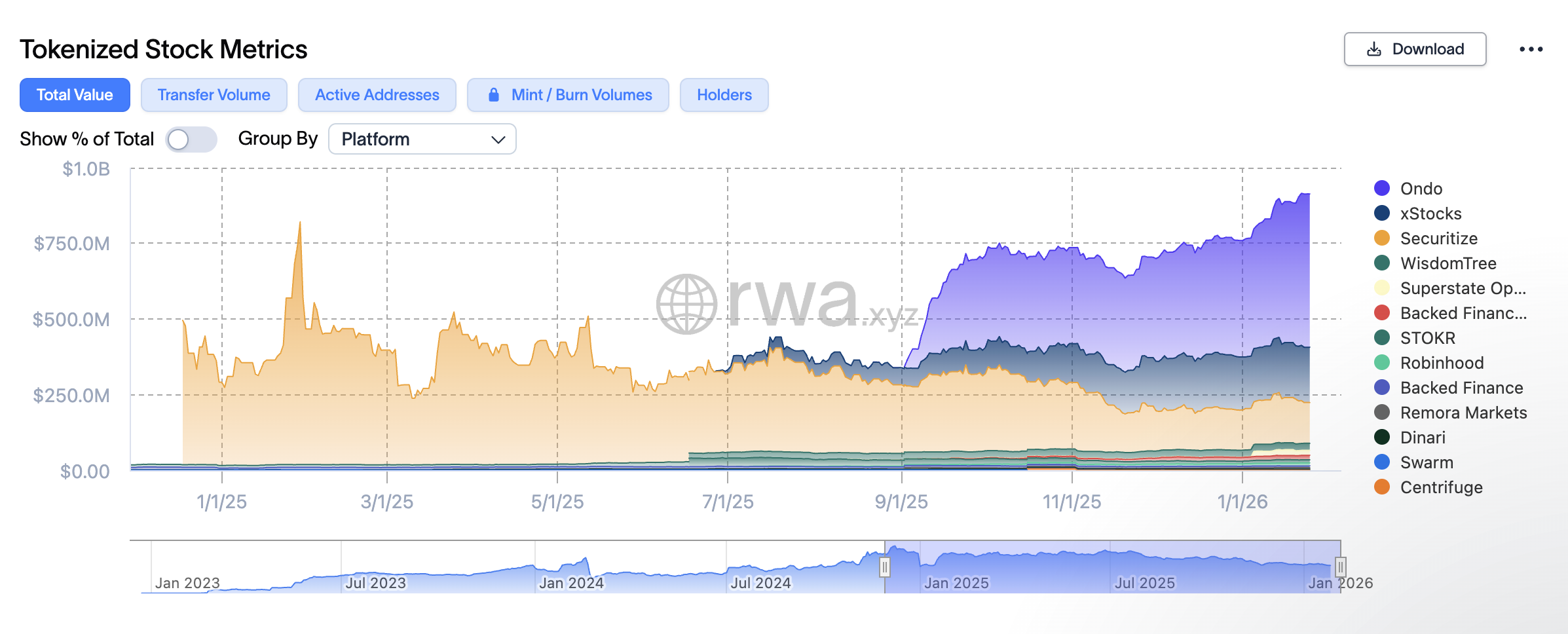

Onchain data shows the tokenized stocks market is approaching a meaningful scale.

Total onchain value tied to tokenized public equities and ETFs stands at approximately $913 million, up 18.66% over the past 30 days. Monthly transfer volume reached $1.86 billion, though activity declined 26.32% over the same period, indicating short-term volatility in trading flows.

User participation has increased sharply. Monthly active addresses interacting with tokenized stock assets rose to 107,702, an increase of 121.53% from 30 days ago. Total holders now number approximately 171,000, up 20.71% over the same timeframe.

Despite the momentum, regulatory uncertainty remains a significant hurdle.

Tokenized equities were among the unresolved issues in the Clarity Act that has gained traction in Congress; Polymarket users are giving it a 53% chance of being signed into law in 2026. Industry executives have said the legislation, as drafted, could slow or limit the rollout of stock token products.

Coinbase CEO Brian Armstrong has publicly criticized the bill, arguing that it should allow the Securities and Exchange Commission greater flexibility to exempt certain tokenized offerings from standard securities requirements.