How Lorenzo Protocol’s Financial Abstraction Layer Can Help Solve the $40 Trillion Yield Problem

An overview of how Lorenzo Protocol’s Financial Abstraction Layer addresses global yield inefficiencies with on-chain capital deployment.

Global financial systems are grappling with an enormous challenge:

The "$40 trillion yield problem."

Much of this capital—U.S. assets held by foreign investors—remains idle, locked in low-yield instruments that struggle to meet return targets or adapt during periods of stress. As global debt levels rise, dollar liquidity tightens, and institutions seek stronger performance, the need for smarter capital allocation has never been more urgent.

This article explores the structural forces behind the $40 trillion problem and how Lorenzo Protocol’s Financial Abstraction Layer can help reduce it by enabling more efficient, programmatic deployment of capital on-chain.

Understanding the $40 Trillion Yield Problem

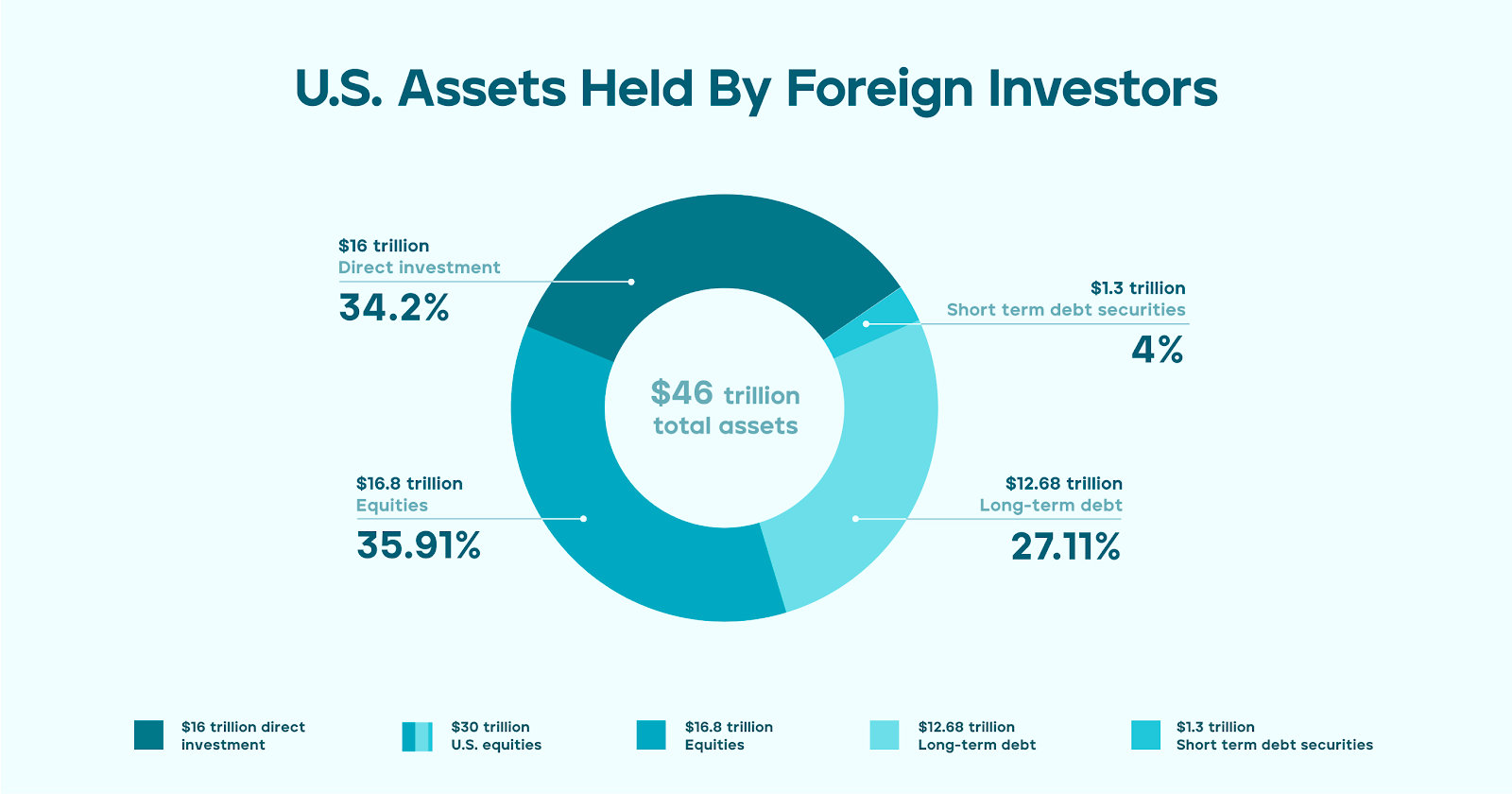

Now, roughly $46 trillion in U.S. assets, comprising $16 trillion in direct investment and $30 trillion of U.S. Securities (equities, long-term debt, etc.), are held by foreign investors.

These holdings form the backbone of global financial stability, but they are increasingly vulnerable to systemic risks amplified during economic stress. Three forces in particular threaten to destabilize this capital stack: global dollar shortages, foreign liquidation pressure, and the persistent drag of low-yield environments.

- Global Dollar Shortages

As of late 2024, non-U.S. borrowers held over $13.2 trillion in U.S. dollar-denominated debt, according to the Bank for International Settlements. Much of this debt is concentrated in emerging markets, where rising interest rates, a surging dollar, and high refinancing costs have created a “perfect storm” of liquidity stress. The IMF warned in October 2024 that over $400 billion in external debt service was due across low- and middle-income countries, many of which have been priced out of capital markets or are paying double-digit yields to refinance. The dollar’s global role, while stabilizing, can paradoxically become a choke point during downturns, as demand for dollars rises while supply tightens.

- Market Volatility and Forced Liquidations

During periods of acute stress, foreign investors often sell U.S. assets to raise dollars. In late 2024, several emerging-market central banks sold U.S. Treasuries to defend their currencies, contributing to a sharp rise in yields. The New York Fed reported that foreign official holdings of Treasuries dropped to $2.85 trillion, their lowest level since the COVID-era liquidity crunch in 2020. Back then, foreigners sold over $119 billion in Treasuries within weeks, triggering a breakdown in bond market liquidity.

- Low Yields and Capital Inefficiency

Despite rate hikes, the hunt for real yield persists. In 2024, the 10-year Treasury yield briefly exceeded 5%, but inflation-adjusted yields remain modest and inconsistent. Meanwhile, trillions of dollars in stablecoins, Treasuries, and bank reserves remain idle or underutilized. Capital misallocation continues to push institutional investors toward alternative yield sources, such as $2.1 trillion in private credit, which offers higher returns but often higher risk and less transparency.

These dynamics—scarce access to dollars in some regions, oversupply of idle capital in others, and volatile capital flows in between—reveal deep inefficiencies in the current global financial architecture.

Enter the Financial Abstraction Layer (FAL): yield infrastructure that helps directly address the core challenges of the $40 trillion problem through on-chain means.

The Basics Of The Financial Abstraction Layer

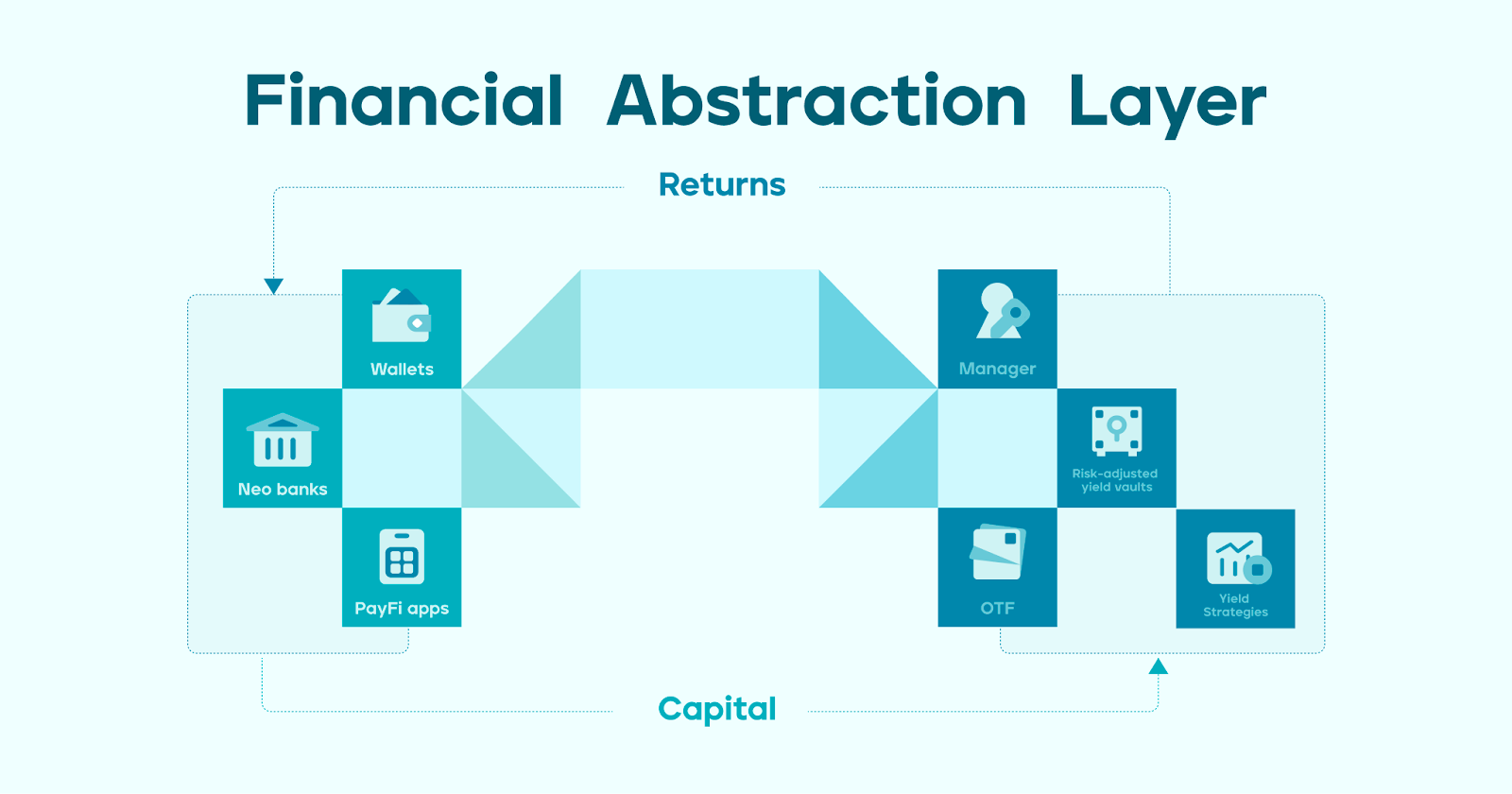

The FAL is a groundbreaking infrastructure built to solve the prominent capital inefficiencies in Payment Finance. It serves as a DeFi product launchpad and management support system for scaling underlying yield sources.

The Financial Abstraction Layer (FAL) introduced by Lorenzo Protocol in 2025 is designed to address these inefficiencies head-on through a modular on-chain infrastructure for real yield. By abstracting and tokenizing centralized financial strategies like staking, arbitrage, and quant trading into verifiable, yield-bearing tokens, FAL enables capital to flow more efficiently between those who hold it and those who need it.

Think of it as an institutional-grade bridge: on one side, wallets, PayFi apps, neobanks, and card platforms can plug into Lorenzo’s system to deploy idle user funds. On the other side, capital is routed into risk-adjusted yield vaults managed by professional strategy providers. Participating users buy an OTF to gain exposure to the yields, accruing real yield from underlying financial activity as they hold.

How The Universal CeDeFi Layer Can Solve The $40 Trillion Problem

It's estimated that, excluding cryptocurrencies, the market cap of tokenized assets could reach around $2 trillion by 2030, driven by the tokenization of bonds, equities, etc.

"Based on our analysis, we expect that total tokenized market capitalization could reach around $2 trillion by 2030 (excluding cryptocurrencies like Bitcoin and stablecoins like Tether), driven by adoption in mutual funds, bonds and exchange-traded notes (ETN), loans and securitization, and alternative funds. In a bullish scenario, this value could double to around $4 trillion, but we are less optimistic than previously published estimates as we approach the middle of the decade." - McKinsey & Company

As this trend continues, holders of inefficiently allocated capital will inevitably seek on-chain asset management firms in search of higher performance.

It's a flywheel effect:

- More assets are brought on-chain.

- These assets are brought to firms like Lorenzo Protocol to manage.

- The Financial Abstraction Layer returns superior yields compared to those that are available in archaic TradFI methods, prompting more assets to be brought on-chain.

While the road ahead is long, as an advanced financial model driving the allocation of on-chain capital to the most profitable yield sources, the Financial Abstraction Layer has the potential to transform how institutions and individuals approach yield generation, opening the door to helping reduce the $40 trillion in ineffectively allocated foreign investor capital.

Here are the primary drivers behind the potential reduction:

- Stabilizing Yields: The Financial Abstraction Layer provides institutions with a robust alternative to traditional low-yield instruments. By leveraging advanced trading strategies on CEXs, it generates higher and more predictable returns, reducing reliance on U.S. Treasuries.

- Improving Capital Resilience: By deploying idle capital into diversified, risk-adjusted yield strategies, the Financial Abstraction Layer helps reduce concentration in traditional low-liquidity instruments. This makes portfolios more resilient and less vulnerable to forced asset sales during periods of dollar scarcity.

- Activating Idle Reserves: Large volumes of stablecoins and custodial assets often sit idle within exchanges, wallets, and fintech platforms. Lorenzo’s architecture allows these assets to be passively deployed into yield-generating modules, turning dormant balances into productive capital.

- Evoking Institutional Confidence: The Financial Abstraction Layer combines blockchain's transparency and high-yield potential with CeFi’s liquidity and stability, creating a platform for institutions to deploy capital confidently across diverse strategies.

The Future of FAL and Global Finance

By aligning idle capital with productive strategies and embedding yield into everyday on-chain flows, such as payments, deposits, and collateral, the Financial Abstraction Layer introduces a more efficient framework for capital deployment. In a world saturated with U.S. assets, yet starved for sustainable yield, this infrastructure demonstrates a new path forward: one that could meaningfully improve how global capital is managed if adopted at scale.

Rather than simply bridging CeFi and DeFi, the Financial Abstraction Layer integrates the best of both worlds, uniting institutional-grade structure, on-chain transparency, and AI-optimized strategy execution. It reimagines how capital is sourced, deployed, and circulated across global systems.

As on-chain finance scales, so too will the potential impact of this model. It has the capacity to enhance yield generation and reshape capital flows, making returns more accessible, allocations more intelligent, and the broader financial system more resilient.