How PayFi Platforms Can Unlock Yield With Tokenized Vaults

How PayFi apps can unlock new revenue and user rewards by embedding yield through tokenized vaults.

Crypto-native payment platforms have unlocked seamless global value transfer. Billions of dollars now move across wallets, cards, and stablecoin payment rails each month, reshaping remittances, commerce, and user onboarding. But while these platforms excel at moving value, few have figured out how to grow it.

Most PayFi systems are built around idle capital. Users preload stablecoins onto cards, transfer BTC to custodial wallets, or maintain balances in apps that function like digital checking accounts. These assets rarely generate yield, leaving capital inert and monetization limited.

This inefficiency is becoming harder to ignore. In traditional finance, banks monetize deposits, but that model largely hasn’t transferred over (aside from Tether, for example, which earned $1 billion in profit in Q1 2025 thanks to user deposits). In PayFi, platforms often sit on high-liquidity, zero-yield balances.

Tokenized vaults offer a solution. By integrating programmable, risk-managed vaults into their backend, PayFi platforms can transform passive balances into yield-bearing infrastructure, powering rewards, reducing costs, and introducing sustainable revenue models.

In this article, we’ll explore tokenized vaults and how they give PayFi platforms the tools to move from transactional gateways to programmable financial engines.

PayFi’s Capital Problem: Collateral, Not Capital

Most PayFi platforms hold user assets as collateral, not as actively managed capital. These balances may back debit cards, payment wallets, or peer-to-peer transfers, but they typically sit untouched until moved again.

A stablecoin wallet may preload for a remittance payout that doesn't execute for 12 to 24 hours. A crypto card issuer may hold USDC or BTC in reserves to meet settlement guarantees. A payments app may store user funds on-chain but never deploy them into yield-generating strategies.

Crypto-native PayFi platforms are collectively sitting on billions in idle collateral. Rain requires users to deposit USDC into vaults to set credit limits—capital that remains idle until spent. Reap processes more than $2 billion in transactions annually using stablecoin balances to fund Visa card programs and B2B payments. Much of that treasury capital remains unproductive. Bitso, which handled over $6.5 billion in U.S.–Mexico remittances in 2024, historically prefunded liquidity for local disbursements—a common model that locks capital for hours or days.

This dynamic mirrors a broader issue. According to The International Association of Money Transfer Networks, traditional cross-border payments require up to $4 trillion in locked pre-funding globally. PayFi platforms, even those built on stablecoins, replicate this capital inefficiency when they don’t deploy reserves.

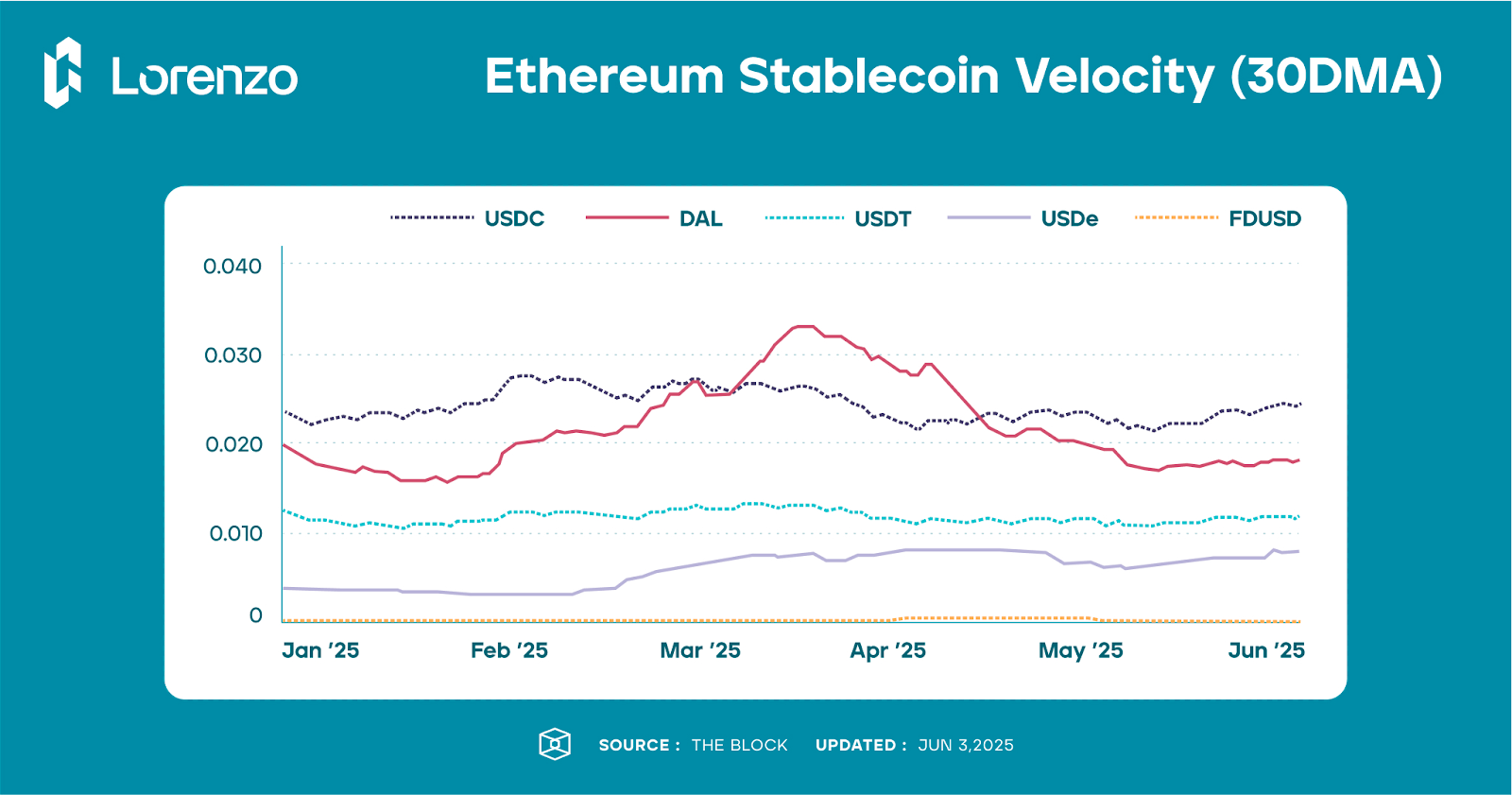

One clear metric that exemplifies the issue is stablecoin velocity, which refers to how frequently a stablecoin's supply is transacted over a given time period. In 2025, the velocity of USDC on Ethereum, for example, has ranged between 0.021 and 0.027 per day, meaning just 2.1% to 2.7% of the circulating supply is transacted daily, while the vast majority sits idle.

Meanwhile, stablecoin velocity is accelerating. In April 2024, major stablecoins like USDC and USDT exhibited on-chain velocity levels near 0.2–0.3 per day, indicating that daily transaction volumes equaled 20% to 30% of the total circulating supply. While value is clearly moving, the majority of capital often remains idle in wallets or protocols.

Tokenized vaults enable platforms to put this idle collateral to work while preserving liquidity, user access, and security requirements.

What Are Tokenized Vaults?

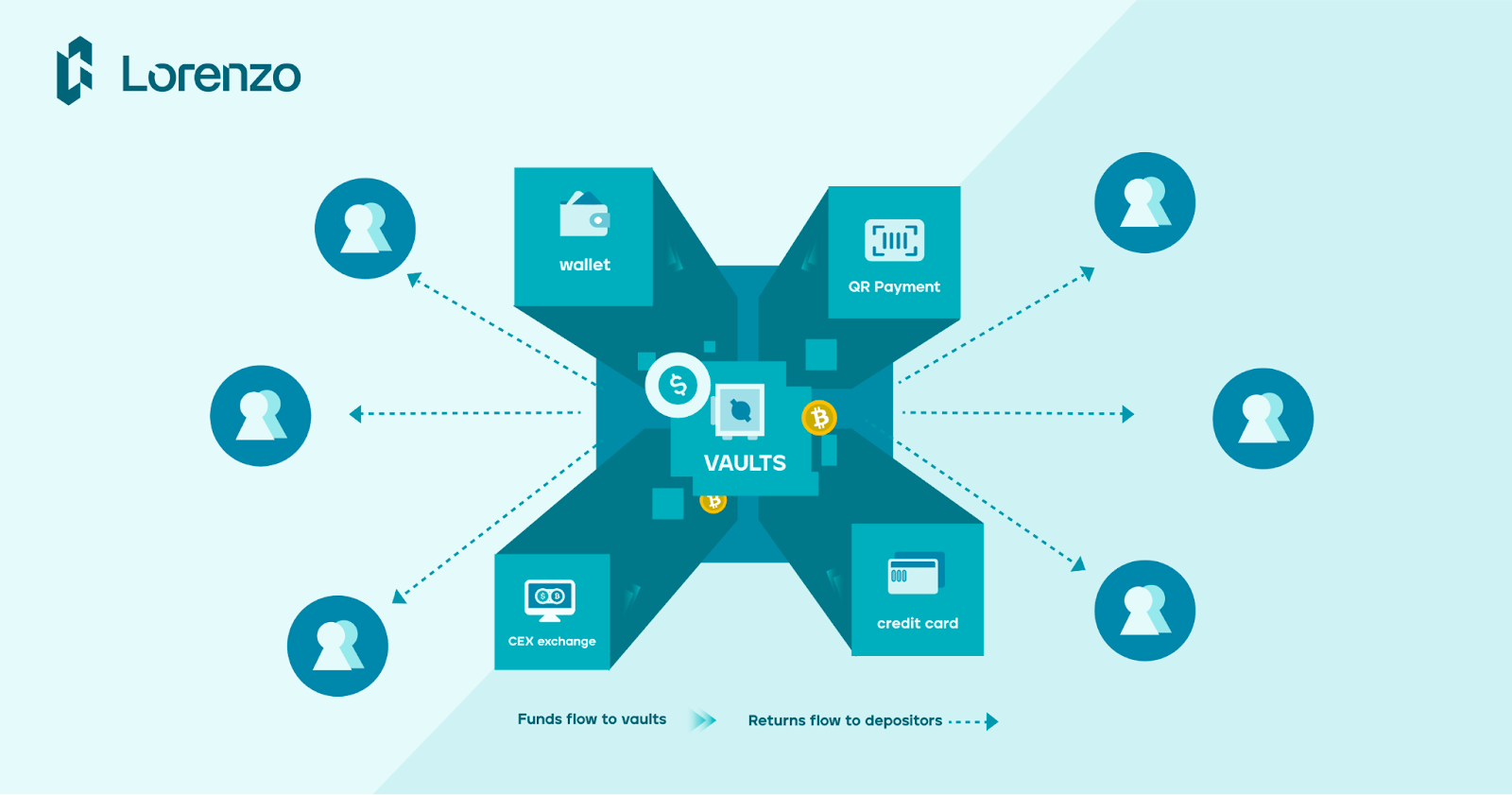

Tokenized vaults are programmable financial containers that package yield strategies, such as fixed yield, principal protection, or multi-asset exposure, into on-chain structures ready to receive capital. They accept deposits, allocate funds according to predefined parameters, and issue tokens that represent the depositor’s position and accrued yield.

Their key innovation is composability. Vaults can be integrated directly into wallets, card systems, and payment interfaces without requiring the platform to manage custody, execution, or user-facing complexity. The yield engine is abstracted; the benefits flow natively.

For PayFi apps, vaults serve as financial infrastructure. They can be fixed-term or rolling, branded or white-labeled, single-strategy or multi-strategy. Because they’re modular, vaults can be deployed behind any system that touches user capital for any duration.

Vaults As Yield-Backed Infrastructure

Vaults give PayFi teams a toolkit to turn static capital into active infrastructure, without overhauling compliance or product architecture. They can also be embedded at the protocol level or used behind user flows without changing UX or exposing users to unnecessary risk. For developers, vaults are programmable and accessible via API, allowing teams to tailor integrations to specific business needs.

Common vault types for PayFi include:

Fixed yield vaults This vault type offers short-duration, predictable returns—ideal for wallet balances and reserve buffers.

Example use case: Auto-deploying wallet balances above a user-defined threshold into a 7-day fixed yield vault.

Principal-protected vaults These vaults maintain capital safety while allocating a fraction to higher-return strategies, well-suited for spendable balances or reward pools.

Example use case: Routing card program collateral into a principal-protected vault until funds are needed for settlement.

Multi-strategy vaults Vaults that rebalance across strategies like BTC staking, RWA financing, and delta-neutral trading to optimize for risk-adjusted returns.

Example use case: Allocating a portion of treasury reserves into a multi-strategy vault to finance cashback or affiliate rewards.

Business Model Impact For PayFi Platforms

Integrating vaults affects more than yield. It unlocks a more resilient, scalable financial model.

Platforms can retain a portion of the yield generated by user balances. For example, routing $20 million into a 5 percent APY vault yields $1 million annually, without introducing the complexities of creating their own yield solutions.

Vault revenue can also expand the business model, helping fund cashback programs, rewards, and fee-free user experiences, for example. Rather than relying on token inflation or venture capital, platforms can offer economically sustainable incentives powered by real returns.

Yield-bearing accounts consistently lead to deeper user engagement. Coinbase’s 2023 decision to raise USDC APY to 6 percent, for example, was a strategic move to improve customer retention. Traditional fintechs introducing interest-bearing balances regularly report increased deposits, retention, and average user activity.

Finally, vault revenue diversifies income beyond transaction fees. As payment margins compress, vaults offer a scalable alternative—one that grows with platform adoption, not just transaction volume.

Lorenzo Protocol’s Vault System For PayFi

Lorenzo Protocol provides partners with the infrastructure layer that makes custom vault integrations easy. Its Financial Abstraction Layer brings curated yield strategies into vault products that PayFi apps can integrate.

Lorenzo supports both white-labeled and branded deployments. It handles custody routing to trusted third parties, yield execution logic, and yield calculation on behalf of partner platforms. Real-time performance dashboards and optional settlement configuration ensure institutions retain full transparency and operational control.

For PayFi teams, Lorenzo is the all-in-one backend infrastructure that makes vault integration into products easy to start and simple to manage.

Payment Apps Are The New Banks

Banks monetize deposits. Most crypto payment apps do not. With Lorenzo Protocol, that is beginning to change.

Tokenized vaults make it possible to embed yield into every layer of a PayFi platform—from user deposits to collateral reserves. They enable passive monetization, programmable rewards, and capital efficiency that scales with product adoption.

As users become more yield-aware and the infrastructure matures, embedded yield is shifting from optional to expected. The platforms that offer it first will be the ones users consolidate into, because they won’t just move value, they’ll grow it.

With backend infrastructure like Lorenzo Protocol, PayFi teams can embed yield into their stack without needing to build it themselves.