How Stablecoins Will Power the Creator Economy

How stablecoins can solve payment delays, high fees, and limited access in the global creator economy.

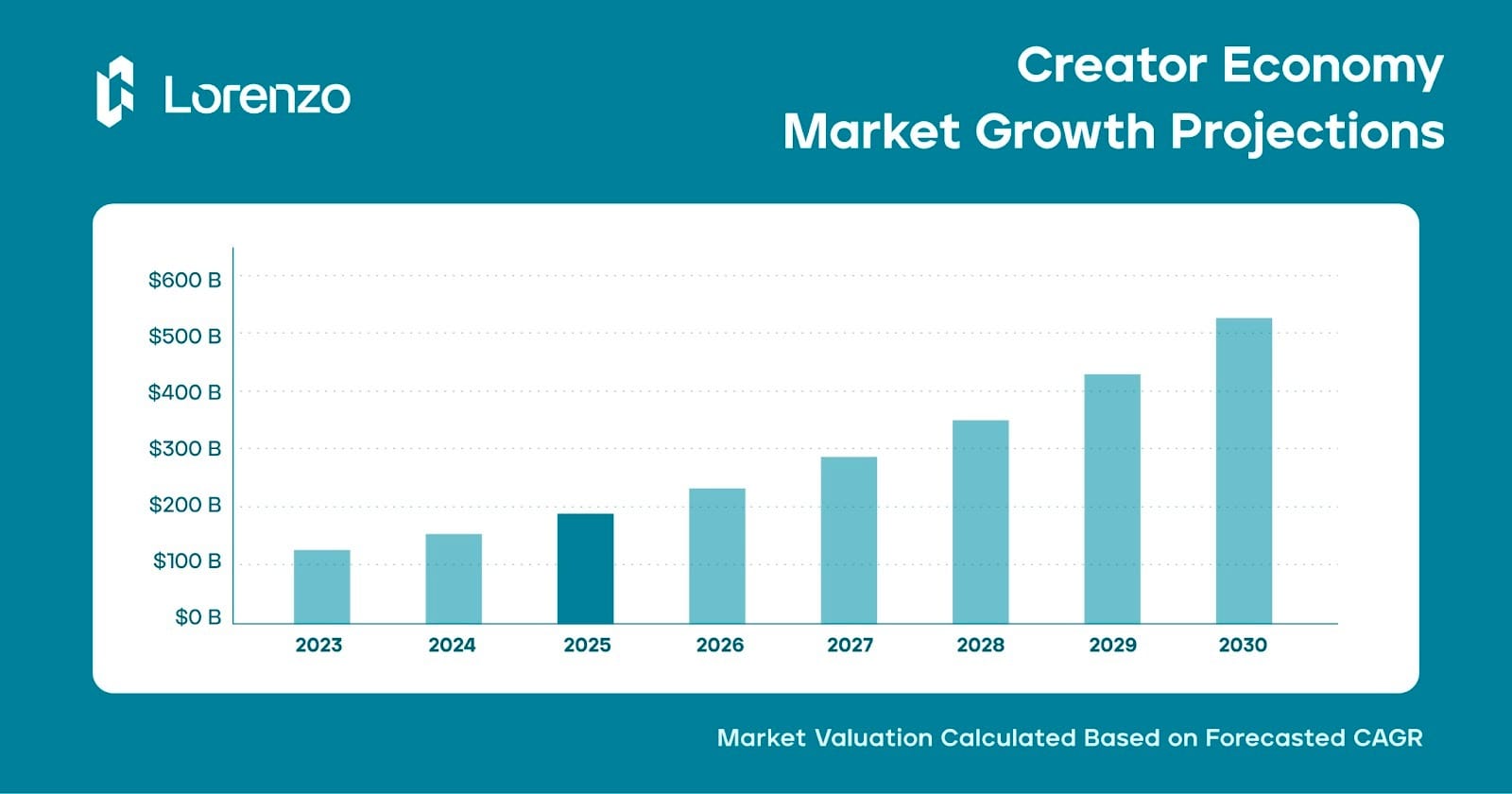

The creator economy, where individuals monetize content through platforms like YouTube, Instagram, and TikTok, is experiencing explosive growth, projected to reach $528 billion by 2027.

With over 207 million content creators globally, this ecosystem is reshaping digital marketing and brand engagement, particularly in North America, where the creator economy is expected to grow from $32.28 billion in 2025 to $142.91 billion by 2030. However, especially in emerging markets with limited access to U.S. dollars, creators face significant challenges with fiat currencies, including payment delays, high transaction fees, and limited financial access.

Stablecoins, cryptocurrencies pegged to stable assets like the US dollar, offer a transformative solution by providing fast, low-cost, and stable transactions. This article explores how stablecoins can address creator pain points, their current applications, and potential future use cases.

The Creator Economy’s Growth and Challenges

The creator economy has become a powerful economic force, enabling influencers to earn money through advertising, sponsorships, subscriptions, and merchandise sales. In 2025, the sector supports millions of creators, with top YouTube creators earning $60,000 annually from ads alone.

However, many struggle with financial stability due to payment inefficiencies.

Creators face significant hurdles with fiat currencies, such as payment delays, with monthly payouts sometimes taking days or even weeks to process fully, depending on the platform. International creators experience even longer delays, sometimes up to 30 days, due to regulatory and banking constraints. High transaction fees further erode earnings, with PayPal charging 2.99% plus $0.49 per US transaction (for businesses in 2025), and adding additional fees, depending on the purpose, for cross-border transactions. Currency conversion introduces volatility, with fluctuating rates and additional fees reducing profits. In regions like Sub-Saharan Africa or Southeast Asia, limited banking access restricts creators’ ability to receive payments, hindering their global reach.

To support the growth of creators worldwide and further the impact social media can have for anyone, regardless of geography, a more efficient financial system is needed.

Stablecoins: A Solution for Creators

Stablecoins, such as USDC and USDT, are cryptocurrencies pegged to stable assets, ensuring price stability while leveraging blockchain’s speed and accessibility.

They address creator challenges effectively by enabling near-instant settlements, often within seconds (depending on which underlying blockchain they are processed on), compared to days or weeks with traditional banking, ensuring prompt access to earnings. Transaction fees are significantly lower, often below $0.01 on blockchains like Solana, preserving creator income, especially for international payments. Since stablecoins are typically USD-pegged, they eliminate currency conversion risks and fees, providing predictable payouts.

The global reach of stablecoins allows anyone with internet access to freely transact, enhancing financial inclusion in underserved markets. Integration with DeFi and Web3 platforms, such as yield farming on Aave, opens new monetization opportunities, while their stability avoids the volatility of other cryptocurrencies, ensuring reliable earnings. These benefits position stablecoins as a game-changer for the creator economy, enabling creators to focus on content rather than financial hurdles.

Current Applications of Stablecoins in the Creator Economy

Although limited in creator economy functionality today (largely to Web3-first platforms like Abstract Stream), stablecoins are already making inroads into the creator economy, with major platforms exploring their potential.

For example, Meta is in discussions to integrate USDC and USDT for Instagram creator payouts, aiming to provide low-cost, efficient cross-border payments. This initiative could scale by 2026, offering a model for other platforms like TikTok, driven by creator demand for faster payouts.

Future Predictions and Emerging Use Cases

Stablecoins are poised to reshape the creator economy by unlocking new monetization models across gaming, social media, and digital commerce. Here are three areas where stablecoins may have the most transformative impact:

Video Game Economies

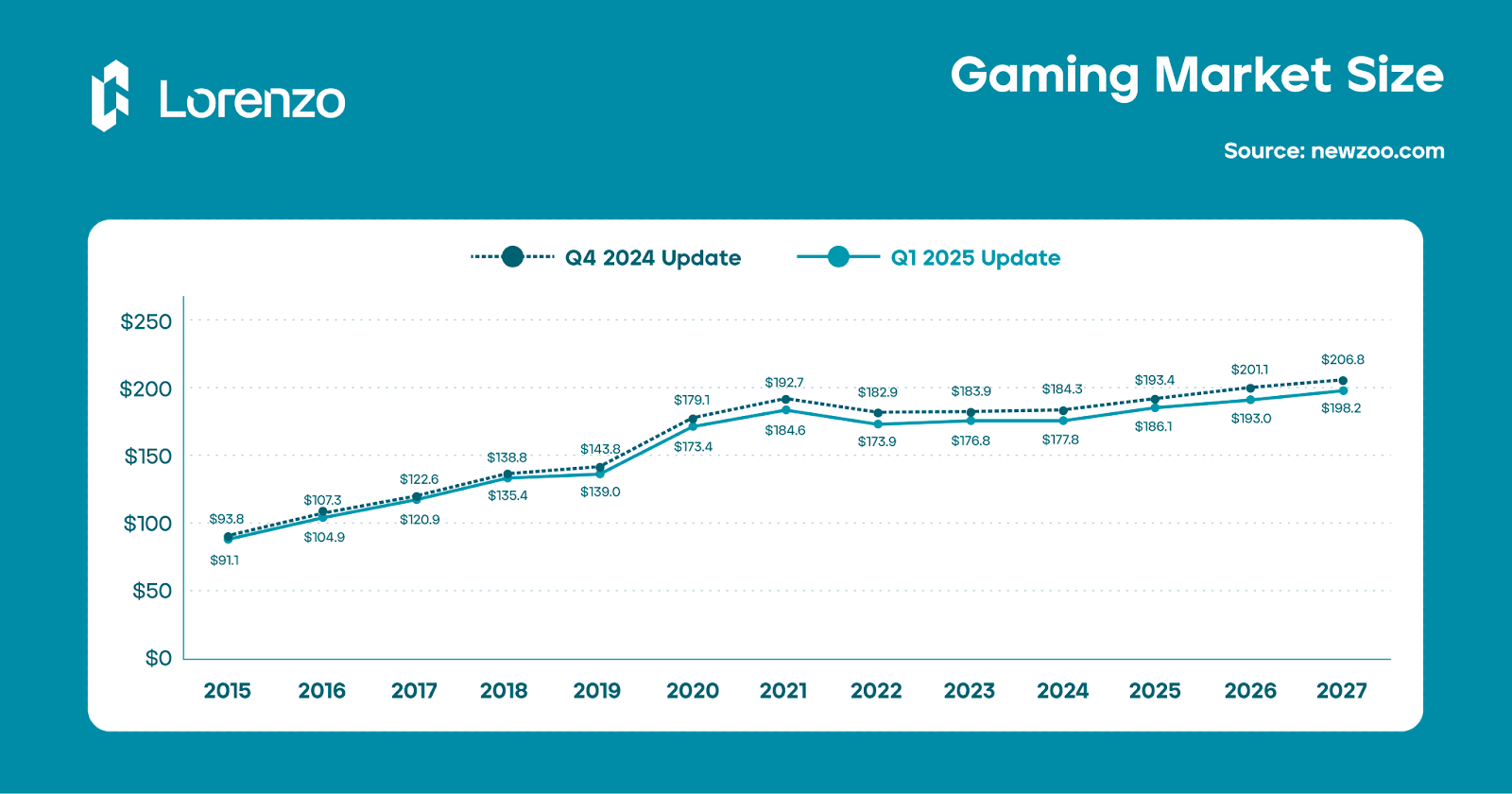

With the global gaming market reaching $177.9 billion in 2024, video games present a natural fit for stablecoin integration. Blockchain-based games on platforms like Solana and Ethereum could adopt stablecoins such as USDC to facilitate seamless, low-cost transactions. Creators—including streamers and esports players—could earn stablecoins via gameplay, tips, or NFT sales, all without the volatility of traditional crypto tokens. As blockchain gaming expands, stablecoins could underpin virtual economies and enhance monetization for creators.

Creator Monetization on Platforms Like X

X’s ambition to become an “everything app” has fueled speculation about stablecoin integration. While still unconfirmed as of 2025, such a move could allow users to tip creators, purchase digital content, or engage in peer-to-peer payments using stablecoins. Similar experiments by Meta, like testing USDC for Instagram payouts, hint at broader industry momentum. Despite regulatory and technical barriers, stablecoins could position X to lead the next wave of creator monetization infrastructure.

Stablecoins in In-App Shops

TikTok’s growing in-app commerce ecosystem could benefit from stablecoin-based payments, especially for microtransactions. Compared to fiat systems with high fees and delays, stablecoins offer faster, more cost-efficient settlement. For creators, this means greater revenue retention and more reliable payouts, critical in regions with volatile local currencies.

Programmable stablecoins could also enable loyalty systems or token-based rewards to drive engagement. Although not yet announced, TikTok may move in this direction to stay competitive with other tech giants.

Challenges and Timelines

Stablecoin adoption is not without obstacles. Regulatory clarity on fiat-backed stablecoins and improvements in blockchain scalability remain critical. Gaming integrations could materialize within the next 1–2 years, while adoption by major social platforms may take longer—likely 3–5 years—due to compliance requirements.

Still, the combination of low friction, global accessibility, and programmability makes stablecoins a compelling tool to redefine creator monetization models worldwide.

A New Financial Engine for the Creator Economy

The creator economy is booming, but the financial rails it runs on remain outdated. Payment delays, high fees, and limited global access continue to constrain creators’ earning potential, particularly in emerging markets. Stablecoins offer a timely upgrade: fast, low-cost, and borderless payments that preserve income and expand access.

As early use cases emerge—from Web3-native platforms to pilot integrations by Meta—the path is being paved for broader adoption. In the near future, stablecoins could become the default tool for creator payouts, powering everything from in-game rewards to tipping and digital storefronts.

While challenges remain, the direction is clear. Stablecoins aren’t just a crypto tool; they’re infrastructure for the next generation of digital entrepreneurship. By streamlining how creators get paid, they free up attention and energy for what matters most: making content, building communities, and growing global influence.