Lorenzo Letter #02: Welcoming World Liberty Markets

World Liberty launches its first lending app, BNB Chain speeds up transactions, and crypto card payments reach $1.5B per month.

Welcome to the Lorenzo Letter, your weekly update on stablecoins, DeFi, tokenization, crypto legislation, and more.

In This Issue:

- World Liberty Financial launches World Liberty Markets

- BNB Chain activates Fermi Upgrade

- Monthly crypto card payment volume reaches $1.5 billion globally

World Liberty Financial Launches World Liberty Markets

World Liberty Financial has launched its first web-based platform, World Liberty Markets, giving USD1 holders access to lending, borrowing, and yield opportunities through Dolomite’s decentralized infrastructure.

The new app allows users to supply USD1 and other supported assets as collateral, earn yield, and borrow against their positions. It marks the first time decentralized credit services are available within the World Liberty Financial ecosystem.

“A year ago, we set out to build a stablecoin that could compete with the biggest names in crypto, and USD1 has exceeded every expectation,” said Zak Folkman, Co-Founder and COO of World Liberty Financial. “Now we’re giving USD1 users access to even more ways to put their stablecoins to work.”

Key features include:

- Lend and borrow using USD1 and other major assets

- Earn yield by supplying collateral

- Borrow against supported crypto assets

- Built on Dolomite’s DeFi infrastructure

- Integrated with the USD1 Points Program

- Web app live, mobile app coming soon

To date, the total market size on the app has surpassed $145 million.

Fully Story:

BNB Chain Activates Fermi Upgrade

BNB Chain has activated its Fermi hard fork on BNB Smart Chain, cutting block times from 0.75 seconds to around 0.45 seconds and moving the network closer to near one-second transaction finality. The upgrade builds on earlier performance improvements and introduces tighter validator coordination rules to keep confirmation times fast and stable during periods of heavy network activity.

With BNB Smart Chain processing billions of transactions each year, the faster block intervals are expected to significantly reduce overall confirmation delays for users and decentralized applications.

Nina Rong, executive director of growth at BNB Chain, noted that BNB Smart Chain processed 4.15 billion transactions last year. If the network handles a similar volume this year, the reduced block times could save more than 1.24 billion seconds in total block production time, equivalent to roughly 39.5 years.

The Fermi upgrade is designed to support latency-sensitive use cases such as onchain trading, real-time DeFi protocols, interactive gaming, and responsive wallets, while remaining fully compatible with existing smart contracts.

More Details:

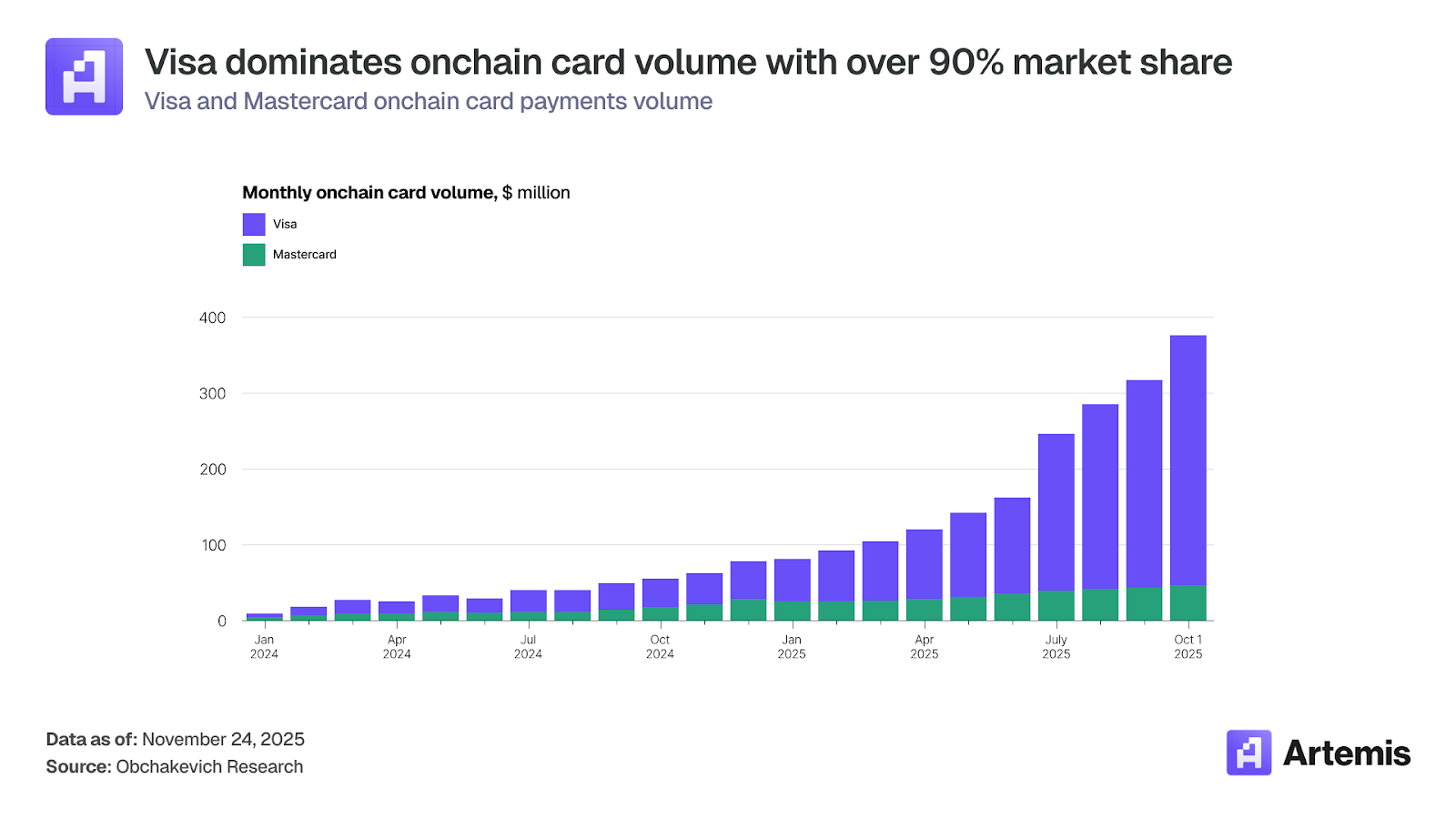

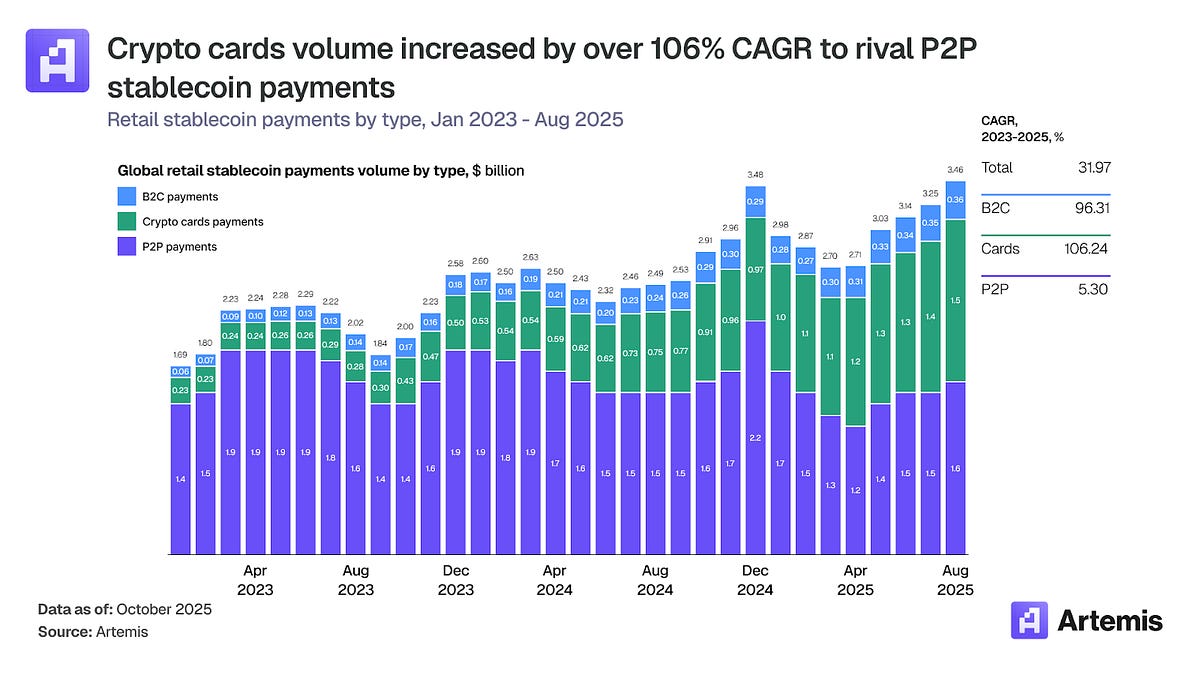

Global Crypto Card Payments Hit $1.5B Per Month

Global crypto card payment volume has surged to $1.5 billion per month, up from just $100 million in early 2023, according to a new report from Artemis. Growth has been strongest in regions where stablecoins solve real economic challenges, such as Argentina, where users rely on crypto cards for inflation hedging and cross-border value storage.

Rather than replacing traditional card networks at checkout, stablecoins are increasingly powering behind-the-scenes settlement, combining global acceptance with faster, more flexible value movement. The trend is being reinforced by major infrastructure players like Rain, which recently raised $250 million to scale its stablecoin card platform, and Visa, which reported stablecoin settlement volumes reaching a $4.5 billion annualized run rate driven largely by crypto card providers.

Read The Report:

Disclaimer

This newsletter is published for informational and research purposes only. Any discussion of projects, tokens, or protocols is intended to illustrate broader market trends and does not constitute financial, investment, or legal advice. References to third-party projects are not endorsements, partnerships, or affiliations with Lorenzo Protocol.

Readers should conduct their own due diligence and exercise caution when engaging with any project or platform mentioned. Lorenzo Protocol makes no representations or warranties regarding the accuracy, completeness, or reliability of information contained herein, and assumes no liability for any losses or damages arising from its use.