Lorenzo Letter #03: NYSE To Bring Trading Onchain

The New York Stock Exchange is working on a blockchain trading platform, Donald Trump Jr. unveiled the World Liberty Forum, and Ripple's CEO predicts a Binance return to the U.S. market.

Welcome to the Lorenzo Letter, your weekly update on stablecoins, DeFi, tokenization, crypto legislation, and more.

In This Issue:

- New York Stock Exchange is building a tokenized trading platform

- World Liberty Financial announces World Liberty Forum

- Ripple CEO predicts a Binance return to U.S. markets

NYSE Developing 24/7 Tokenized Trading Platform

The New York Stock Exchange is building a blockchain-based platform that could enable 24/7 trading and onchain settlement of tokenized U.S. stocks and ETFs, pending regulatory approval. The system would combine NYSE’s existing Pillar matching engine with blockchain infrastructure to support real-time trading, fractional shares, dollar-denominated orders, and instant settlement using tokenized capital, including stablecoins.

Michael Blaugrund, vice president of strategic initiatives at Intercontinental Exchange (ICE), said the platform reflects the evolution of NYSE’s trading model from floor-based trading to electronic markets and now to blockchain-enabled infrastructure. The goal is to give retail and institutional investors continuous access to markets, allowing trades and settlement to occur outside traditional banking and exchange hours.

If approved, the platform would operate as a new NYSE venue for digital securities, supporting both tokenized versions of traditional shares and natively issued digital assets. Tokenized investors would retain the same dividend and governance rights as traditional shareholders, with access provided through qualified broker-dealers.

Full Story:

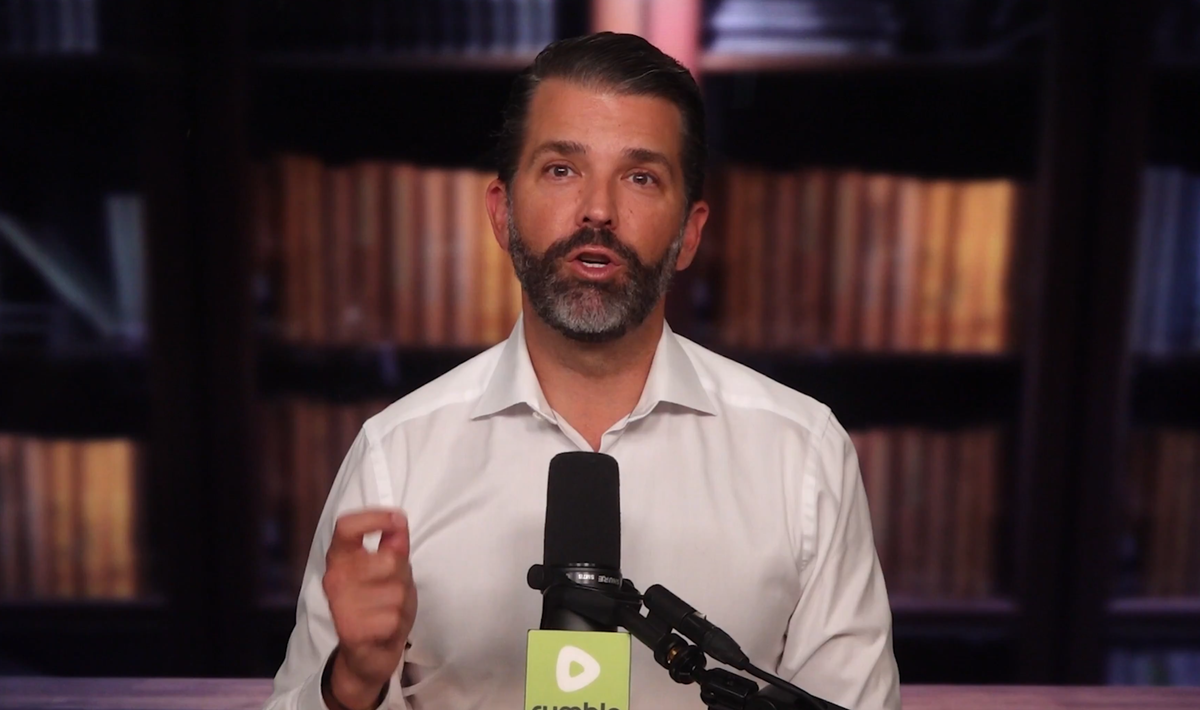

Donald Trump Jr. Unveils World Liberty Forum

World Liberty Financial is launching the World Liberty Forum, an invitation-only event at Mar-a-Lago focused on the future of finance and technology. The forum will bring together a select group of 300 global leaders for off-the-record conversations designed to explore emerging trends across financial systems, policy, and innovation.

Donald Trump Jr., co-founder of World Liberty Financial, described the forum as “the most exclusive event in technology and finance,” emphasizing that the gathering will avoid scripted panels in favor of open, high-level discussions that can only happen when influential figures are in the same room.

The event will be hosted by World Liberty Financial co-founders Eric Trump, Donald Trump Jr., Zach Witkoff, and Alex Witkoff. Confirmed speakers include David Solomon, Chairman and CEO of Goldman Sachs; Gianni Infantino, President of FIFA; and Jacob Helberg, U.S. Under Secretary for Economic Affairs.

Attendance is limited, with prospective guests able to apply as attendees, speakers, or media through the event’s official website.

Full Story:

Ripple CEO Predicts Binance Will Return to U.S. Market

Ripple CEO Brad Garlinghouse said he expects Binance to eventually reenter the U.S. market, citing the country’s importance as a growth opportunity for the world’s largest cryptocurrency exchange. Speaking at CNBC’s event in Davos, Garlinghouse said Binance’s past presence in the U.S. and its global ambitions make a return likely.

“It’s a very large market,” Garlinghouse said. “I think they’ll come back because they’re a capitalistic, innovative company that wants to solve larger markets and continue to grow.”

Binance exited the U.S. in 2023 after a $4.3 billion settlement with the Department of Justice over compliance failures. Former CEO Changpeng Zhao later received a presidential pardon, removing a major legal barrier to the company’s potential return.

While Garlinghouse is optimistic, Binance itself is taking a more cautious stance. Co-CEO Richard Teng said the exchange views the U.S. as a “very important marketplace” but is currently adopting a wait-and-see approach as regulatory clarity develops.

If Binance does return, Garlinghouse believes increased competition could lower fees and expand access for U.S. crypto users, a market currently dominated by Coinbase.

Full Story:

Disclaimer

This newsletter is published for informational and research purposes only. Any discussion of projects, tokens, or protocols is intended to illustrate broader market trends and does not constitute financial, investment, or legal advice. References to third-party projects are not endorsements, partnerships, or affiliations with Lorenzo Protocol.

Readers should conduct their own due diligence and exercise caution when engaging with any project or platform mentioned. Lorenzo Protocol makes no representations or warranties regarding the accuracy, completeness, or reliability of information contained herein, and assumes no liability for any losses or damages arising from its use.