Lorenzo Letter #04: Binance's Tokenized Stock Revival

Crypto markets face key shifts as Binance weighs a return to tokenized stocks, U.S. lawmakers advance a CFTC crypto bill, and Bybit moves into banking.

Welcome to the Lorenzo Letter, your weekly update on stablecoins, DeFi, tokenization, crypto legislation, and more.

In This Issue:

- Binance Eyes Return to Tokenized Stock Trading

- Senate Panel Advances CFTC Crypto Bill

- Bybit Prepares To Make Its Banking Move

- Content Spotlight: The Ultimate Guide to World Liberty Financial

Binance Eyes Return To Tokenized Stock Trading

Binance is considering reviving tokenized stock trading on its platform, nearly five years after shutting down a similar offering amid regulatory scrutiny. The exchange is weighing whether to reintroduce stock tokens, which are digital representations of publicly traded shares that allow fractional exposure and onchain settlement.

A Binance spokesperson confirmed the company is exploring tokenized equities as part of a broader effort to bridge traditional finance and crypto. The spokesperson pointed to Binance’s recent support for tokenized real-world assets and the launch of regulated TradFi perpetual contracts settled in stablecoins, calling tokenized equities a “natural next step.”

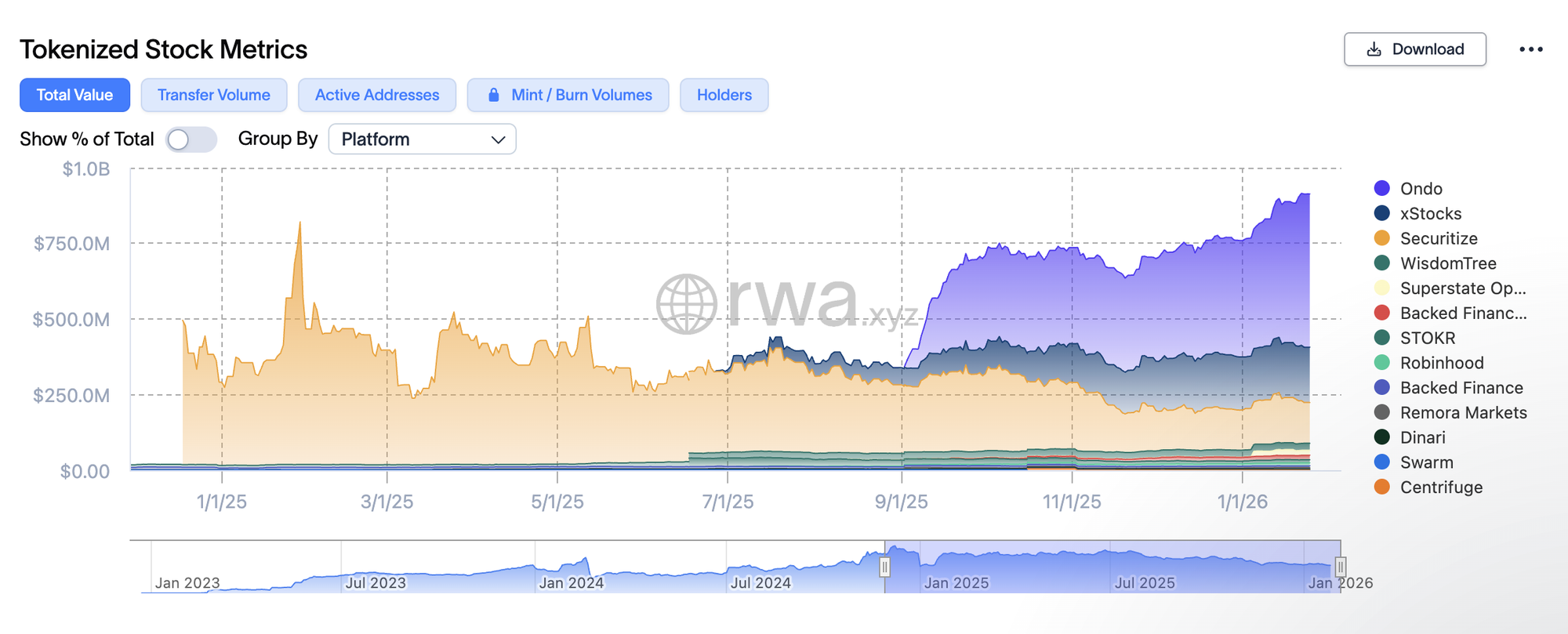

Onchain data shows the tokenized stocks market approaching meaningful scale. Total onchain value tied to tokenized public equities and ETFs stands at approximately $913 million, up 18.66% over the past 30 days. Monthly active addresses rose to 107,702, while total holders increased to roughly 171,000.

Full Story:

Senate Panel Advances CFTC Crypto Bill

The Senate Agriculture Committee voted to advance a major crypto market structure bill on Thursday, marking the first time legislation of this scope has cleared a Senate committee. Lawmakers approved the Digital Commodity Intermediaries Act in a 12–11 party-line vote, advancing a framework that would expand the Commodity Futures Trading Commission's oversight of digital commodities and establish a formal spot market regime for crypto trading platforms.

The bill would define digital commodities, create a registration framework for crypto intermediaries, and introduce consumer protections, while mandating coordination between the CFTC and the Securities and Exchange Commission. Senate Agriculture Committee Chairman John Boozman called the vote a critical step toward regulatory clarity.

Democrats opposed the measure, arguing it dropped key elements from earlier bipartisan talks. Sen. Cory Booker said unresolved concerns around ethics and national security remain, particularly as amendments barring elected officials and their families from issuing or promoting digital assets were rejected. Attention now shifts to the Senate Banking Committee, which has yet to advance its own version of the bill following industry pushback, including criticism from Brian Armstrong.

Full Story:

Bybit Prepares To Make Its Banking Move

Bybit is preparing to enter the neobank space as it rolls out banking-style services that allow users to hold and transfer fiat currencies directly on its platform. The crypto exchange plans to launch a product called MyBank, which will offer fiat accounts with IBANs, CEO Ben Zhou said in an interview with Bloomberg.

MyBank accounts are expected to go live next month, pending regulatory approval, and will support balances in U.S. dollars and other fiat currencies. Users will be able to send and receive up to 18 fiat currencies and convert funds into crypto once they arrive. Bybit is offering the accounts through partnerships with local banks, including Pave Bank, according to Bloomberg.

The move signals Bybit’s push to layer banking services on top of its existing crypto exchange as it expands beyond trading. Zhou said the company is also exploring institutional custody products tied to real-world asset tokenization, while ruling out entry into prediction markets due to compliance concerns.

Full Story:

Content Spotlight: 2026 Guide To World Liberty Financial

World Liberty Financial is one of today's fastest-growing, most discussed crypto industry projects.

As creators of the world's first USD1 yield product, we wanted to publish a reference that explains how the ecosystem works and what matters as 2026 kicks off.

The Ultimate Guide to World Liberty Financial 2026 covers:

- How USD1 scaled into one of the fastest-growing stablecoins (just hit $5B market cap milestone)

- The structure and role of the WLFI governance token

- Trump family ownership and institutional partnerships

- Where USD1 yield comes from and how it’s deployed

- The key regulatory, political, and centralization risks to watch

Read:

Disclaimer

This newsletter is published for informational and research purposes only. Any discussion of projects, tokens, or protocols is intended to illustrate broader market trends and does not constitute financial, investment, or legal advice. References to third-party projects are not endorsements, partnerships, or affiliations with Lorenzo Protocol.

Readers should conduct their own due diligence and exercise caution when engaging with any project or platform mentioned. Lorenzo Protocol makes no representations or warranties regarding the accuracy, completeness, or reliability of information contained herein, and assumes no liability for any losses or damages arising from its use.