On-Chain Traded Funds (OTFs): Rethinking Portfolio Access for the On-Chain Era

An introduction to On-Chain Traded Funds and how they bring portfolio strategies to crypto-native users through programmable, on-chain infrastructure.

Exchange-Traded Funds (ETFs) have transformed traditional investing by offering diversified portfolios through a single, liquid instrument. Today, ETFs provide exposure to everything from U.S. Treasuries to emerging markets and are core components of retail and institutional portfolios alike.

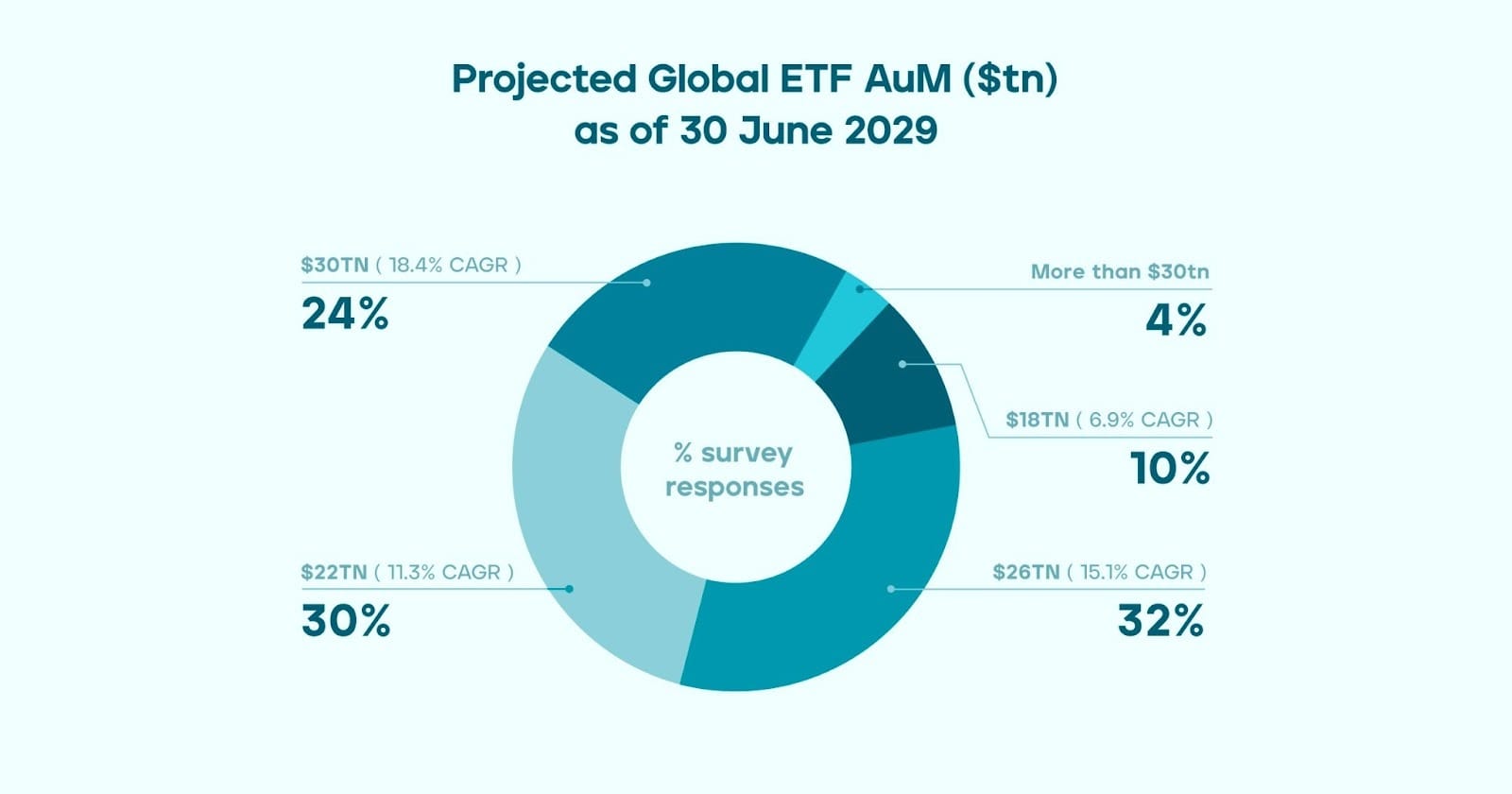

In 2024 alone, the U.S. ETF market saw a record $1.12 trillion in net inflows, growing by a record 27% to reach $14.6 trillion by the end of the year.

Despite this growth, ETFs remain bound to traditional financial infrastructure: accessible primarily through brokers, restricted by market hours, and often limited to regulated jurisdictions.

On-Chain Traded Funds (OTFs), introduced by Lorenzo Protocol, offer a crypto-native alternative for retail users to invest in. While some features of ETFs inspire them, OTFs are a fundamentally different product category built for programmable money and real-time finance. This article explores how OTFs work, what makes them distinct, and why they matter for fintech platforms operating on-chain.

What Are On-Chain Traded Funds (OTFs)?

OTFs are tokenized investment products designed by Lorenzo Protocol to bring sophisticated yield strategies to the internet-native economy. Rather than mirroring traditional products like ETFs, OTFs introduce a new model tailored for programmable money, composability, and global access via public blockchains.

They offer passive exposure to curated portfolio strategies (similar in spirit to how ETFs simplify traditional investing) but operate with fundamentally different infrastructure, governance, and regulatory frameworks.

The core value of OTFs lies in two areas:

Transparency

Because all fund interactions occur on-chain, investors can monitor performance, capital flows, and management decisions in real time: something not easily achievable with traditional financial products.

"You can monitor how Lorenzo is managing the fund and how its performance is. If you purchase a Vanguard or BlackRock product—I'm not saying they aren't doing a great job—there's no way to verify that they are until they pay out the dividends and you cash out successfully. The whole process is behind the scenes, and there's no way to verify if they're really doing the things that they promised." - Matt Ye, Founder & CEO of Lorenzo Protocol

Flexibility

While ETFs are typically traded during market hours and are often subject to jurisdictional restrictions, OTF tokens can move freely 24/7, similar to stablecoins or liquid staking tokens. They can be used across DeFi protocols, integrated into other smart contracts, or held in self-custody wallets with full transferability.

An OTF can include a single strategy or a blend of multiple strategies. Examples include:

- Delta-neutral arbitrage (CEX/DEX)

- Covered call income

- Volatility harvesting (e.g., short VIX)

- Risk-parity and trend-following strategies

- Funding rate optimization in perp markets

Please Note: The performance and sustainability of each strategy depend on infrastructure maturity and market conditions. Some strategies may require off-chain components or hybrid execution.

While technically speaking, OTFs are tokenized fund structures representing shares in an underlying composable vault, which allocates received capital to yield-generating mechanisms (such as the strategies mentioned above), users don’t need to be aware of or interact with the product at that level.

They simply deposit into the OTF vault and receive designated tokens that represent their share of the fund’s performance. These tokens not only entitle users to the fund’s yield, but can also be deployed across DeFi protocols or held and traded freely.

Why OTFs Matter for Fintech

Fintech platforms are under pressure to deliver better returns, intuitive user experiences, and global accessibility without taking on regulatory complexity or heavy infrastructure costs.

Most can’t offer traditional investment products directly, since they lack the licenses to do so. Instead, they rely on banks or asset managers, which can slow innovation and increase costs.

OTFs change that. They offer a modular, crypto-native way to embed passive yield into apps—no asset issuance or full-stack financial infrastructure required.

For example, a payment app could integrate Lorenzo OTFs to let users earn yield on idle balances, turning everyday wallets into investment tools.

With a few lines of code, fintechs can:

- Launch branded savings or investment features

- Monetize idle capital without building out a full financial backend

- Access globally available yield strategies with programmable user flows

As expectations shift toward real-time, always-on finance, OTFs help fintechs respond to user demand, especially in emerging markets where access to traditional ETFs may be limited or delayed.

While OTFs aren’t regulated financial instruments like ETFs, their on-chain design opens new opportunities to serve users in emerging markets who are underserved by traditional infrastructure.

How OTFs Work: On-Chain Fundraising, Settlement, and Off-Chain Execution

OTFs are built on a hybrid framework that combines on-chain programmability with off-chain strategy execution. Instead of functioning as regulated securities, they act as transparent, tokenized vaults that deliver structured investment exposure while maintaining flexibility and composability.

For financial institutions, OTFs offer a foundation for launching and scaling investment products without building asset infrastructure from scratch. Highlighted by on-chain fundraising and settlement, and off-chain execution, OTFs blend the benefits of CeFi and DeFi.

On-Chain Fundraising

Capital is raised directly on public blockchains. This enables access to a global user base without intermediaries and reduces traditional fundraising overhead. For fintechs, it means lower time to market and frictionless onboarding for users with self-custodial wallets.

On-Chain Settlement

All fund interactions, including deposits, redemptions, and performance updates, are recorded on-chain. This creates real-time transparency for net asset value (NAV) calculations, auditability, and automated reporting. It reduces reconciliation risk and provides users with verifiable fund activity at any time.

Off-Chain Execution

While funds are raised and settled on-chain, the underlying strategies may be executed through off-chain venues, such as centralized exchanges. This model allows OTFs to support strategies not natively available on-chain (e.g., fixed income or market-neutral arbitrage), while still benefiting from on-chain transparency and settlement.

Importantly, this structure is not a replication of how ETFs operate. Whereas ETFs are backed by licensed custodians and regulatory disclosures, OTFs follow an open architecture with crypto-native assumptions—self-custody, permissionless access, and composability across DeFi protocols. They are engineered for a different user base, with different expectations around transparency, access, and programmability.

Lorenzo Protocol’s Role

Lorenzo Protocol introduced OTFs as a crypto-native investment primitive tailored for fintech platforms, wallets, and financial apps seeking to embed passive yield without the burden of building asset infrastructure from scratch.

At the core of this offering is Lorenzo’s Financial Abstraction Layer (FAL), a modular infrastructure stack purpose-built to tokenize financial strategies, manage vault operations, and enable seamless integrations across DeFi and custodial environments.

Through this system, Lorenzo:

- Designs and maintains tokenized fund structures that wrap diversified CeFi and DeFi strategies

- Handles institutional-grade custody, yield distribution, and capital efficiency within each OTF

- Offers plug-and-play infrastructure for teams to launch branded investment experiences without building backend asset management capabilities

Each OTF issued via Lorenzo is powered by a curated, risk-adjusted yield strategy optimized for yield, diversified across execution venues, and continuously rebalanced to reflect market conditions.

While both product types aim to simplify access to diversified strategies, Lorenzo’s OTFs are built for a different context, where transparency, composability, and crypto-native programmability take precedence over traditional regulation and custodianship.

OTFs Are the Future of Crypto Yield Access

As passive investing moves beyond traditional financial rails, On-Chain Traded Funds represent a new class of financial product purpose-built for the programmable, decentralized economy.

Designed from the ground up for crypto, OTFs open up new ways to access portfolio strategies, offering transparency, global accessibility, and smart contract–based integration. They make it easier for fintechs, wallets, and protocols to embed investment features natively, while reducing operational friction and enabling access to real yield.

While OTFs may share surface-level traits with traditional fund structures, like bundled exposure and simplified access, their infrastructure, liquidity profile, and regulatory posture differ significantly. OTFs are built for the crypto-native world, not adapted from legacy finance.

For builders and users in decentralized finance, OTFs provide a foundation for innovation in yield access, one that prioritizes composability, transparency, and autonomy. And USD1+ is just the beginning. Lorenzo is building a crypto-native financial terminal for tokenized assets, lending, and advanced yield products, all seamlessly composable and fully self-custodial.

Visit lorenzo-protocol.xyz to learn more or contact the team to get started.