Lorenzo Letter #01: Stablecoins x US Banking Heats Up

Stablecoins are moving deeper into the U.S. banking system as firms pursue federal charters, major banks expand blockchain payments, and new infrastructure supports real-time digital dollars.

Welcome to the Lorenzo Letter, your weekly update on stablecoins, DeFi, tokenization, crypto legislation, and more.

In This Issue:

- World Liberty Financial applies for federal trust bank charter

- Kinexys by J.P. Morgan brings JPM coin to the Canton Blockchain

- BNB Chain publishes 2026 tech roadmap

- Research highlight - yield-bearing stablecoins

World Liberty Financial Applies For Federal Trust Bank Charter

World Liberty Financial has applied for a national trust bank charter with the Office of the Comptroller of the Currency (OCC) to oversee the issuance and management of its USD1 stablecoin.

The company said its subsidiary, WLTC Holdings, submitted a de novo application to operate a federally regulated trust bank focused on digital asset custody, stablecoin issuance, and redemptions. If approved, the charter would allow World Liberty Financial to manage USD1 directly under U.S. banking oversight.

“This application marks a further evolution of the World Liberty Financial ecosystem,” said co-founder Zach Witkoff, who would serve as president and chair of the proposed trust bank.

The support since announcing our application for an OCC charter for USD1 has been incredible.

— WLFI (@worldlibertyfi) January 8, 2026

We appreciate everyone who’s reached out, engaged, and backed the vision.

This is just the beginning of what we’re building 🦅 ☝️

USD1, a dollar-backed stablecoin launched last year, has already surpassed $3.3 billion in circulation, making it one of the fastest-growing stablecoins in history. The company says the new structure would enable fee-free USD to USD1 conversions and provide custodial services for both institutional and retail users.

Earn Yield on USD1: https://app.lorenzo-protocol.xyz/otf/sUSD1Plus-BNB

Full Story:

Kinexys By J.P. Morgan Brings JPM Coin To The Canton Blockchain

Digital Asset and Kinexys by J.P. Morgan have announced a new collaboration that will bring J.P. Morgan’s blockchain-based payment products to Digital Asset's Canton Network, starting with the native issuance and transfers of JPM Coin, J.P. Morgan’s U.S. dollar–denominated deposit token

“This collaboration brings to life the vision of a regulated digital cash that can move at the speed of markets,” said Digital Asset CEO Yuval Rooz.

JPM Coin represents tokenized U.S. dollar deposits held at J.P. Morgan, enabling institutional clients to move funds on a blockchain with near-instant settlement. By integrating it natively into Canton, participants on the network will be able to issue and transfer JPM Coin more efficiently.

JPMorgan CEO Jamie Dimon has also emphasized the bank’s commitment to digital payments, saying deposit tokens and stablecoins serve similar functions in moving money through tokenized systems.

Full Story:

BNB Chain Unveils 2026 Tech Roadmap for Faster, Cheaper, Always-On Finance

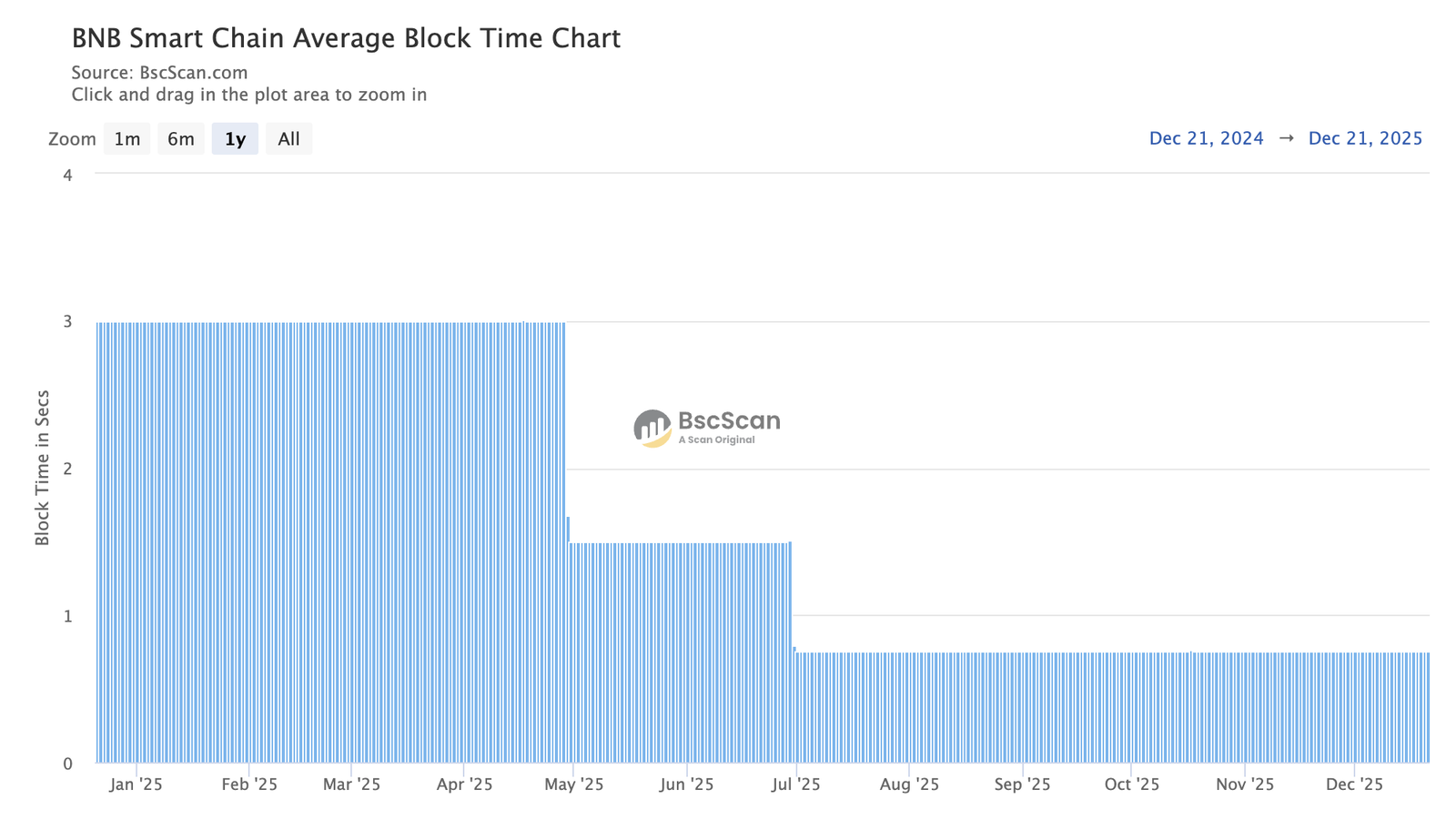

BNB Chain has released its 2026 technical roadmap, which is set to build on a successful 2025 campaign in which the network processed up to 5 trillion gas per day without a single outage, while gas fees dropped from 1 gwei to 0.05 gwei. Sub-second block times and near-instant transaction finality are now standard, positioning BNB Chain as a viable platform for high-volume payments, stablecoin use, and real-time settlements.

The 2026 roadmap builds on that foundation with a focus on BSC as a "highly optimized EVM trading chain."

A few notable upgrades included:

- Dual-client architecture using both Geth and Rust-based Reth for higher resilience

- Faster execution through “Super Instructions” and optimized processing

- Scalable DB storage layer to support long-term state growth

- Continued low gas fees without reducing validator incentives

- Infrastructure designed for stablecoin payments and real-time settlements

Ultimately, the upgrades slated for 2026 are meant to target:

- 20,000 TPS with sub-second finality

- Further reductions in gas fees through software optimizations

- Advanced consensus and network latency improvements to push finality deeper into sub-second territory

Full Story:

Research Highlight - An Analysis of Yield-Bearing Stablecoins

Following the rapid expansion of stablecoin-based yield products, our research team has tracked a wave of structured stablecoin and credit-focused protocols gaining traction across DeFi.

These platforms blend on-chain and off-chain underwriting, structured credit, delta-neutral strategies, real-world asset exposure, and incentive-driven vault mechanics to create enhanced yield opportunities for stablecoin holders.

This report summarizes several leading models shaping the category:

https://medium.com/@lorenzoprotocol/research-an-analysis-of-yield-bearing-stablecoins-b6a505a303c6

Disclaimer

This newsletter is published for informational and research purposes only. Any discussion of projects, tokens, or protocols is intended to illustrate broader market trends and does not constitute financial, investment, or legal advice. References to third-party projects are not endorsements, partnerships, or affiliations with Lorenzo Protocol.

Readers should conduct their own due diligence and exercise caution when engaging with any project or platform mentioned. Lorenzo Protocol makes no representations or warranties regarding the accuracy, completeness, or reliability of information contained herein, and assumes no liability for any losses or damages arising from its use.