The Ultimate Guide To World Liberty Financial 2026

World Liberty Financial 2026: Everything you need to know about USD1 stablecoin, WLFI token, Trump family ownership, yield strategies, and ecosystem risks.

TL;DR: World Liberty Financial is a hybrid DeFi protocol backed by the Trump family that has rapidly grown to become a major force in tokenized finance. With USD1 stablecoin reaching $4.93 billion in circulation and the WLFI governance token ranking among the top cryptocurrencies, the platform is bridging traditional finance with blockchain infrastructure through institutional partnerships and expanding financial services.

World Liberty Financial Quick Reference Table

| Category | Details |

|---|---|

| Founded | 2024 |

| Founders | Zachary Folkman, Chase Herro, Alex Witkoff, Zach Witkoff, Trump family members |

| USD1 Market Cap | $4.93 billion (as of January 2026) |

| WLFI Token Market Cap | $15.94 billion |

| Core Technology | Built on Aave V3 protocol, Ethereum & BNB Chain |

| Primary Services | Lending, borrowing, stablecoin infrastructure, tokenized assets |

| Key Backers | Trump family, Justin Sun, MGX (Abu Dhabi) |

| Regulatory Status | Applied for national trust banking charter (January 2026) |

What is World Liberty Financial?

World Liberty Financial (WLFI) is a decentralized finance protocol that merges traditional banking infrastructure with blockchain technology through a dual-token system anchored by its USD1 stablecoin and WLFI governance token.

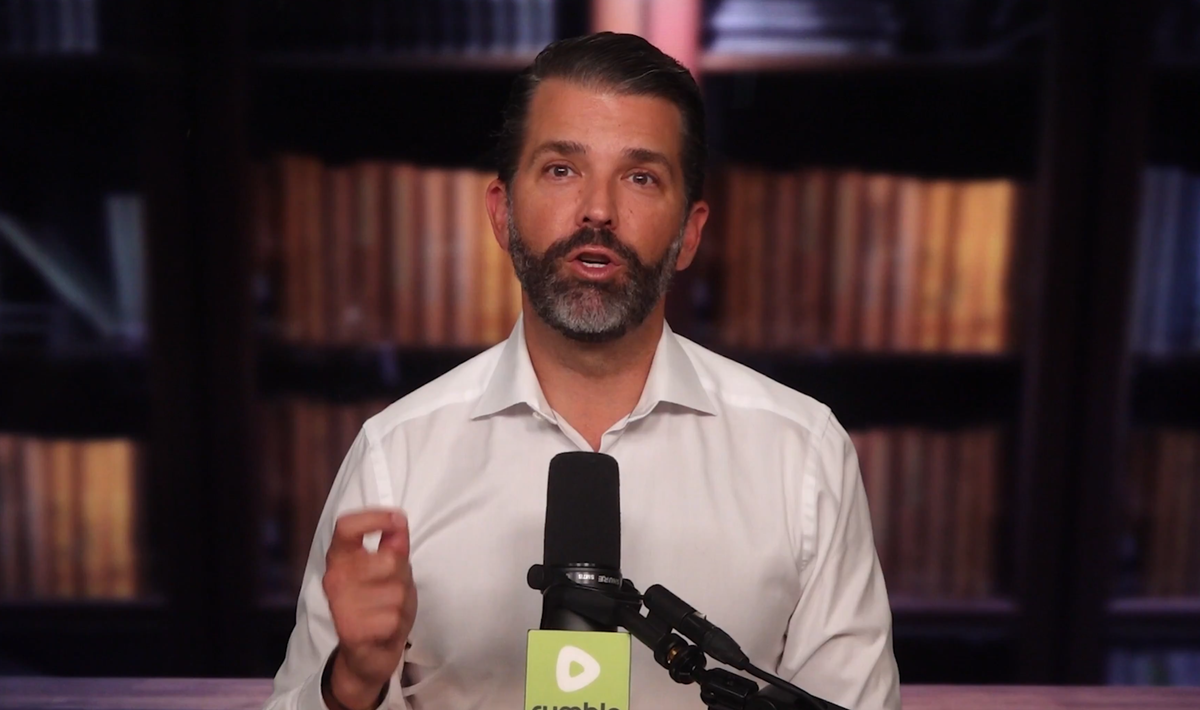

Launched in 2024 with direct backing from the Trump family, the project represents the most politically connected ventures in cryptocurrency history. Donald Trump serves as "Chief Crypto Advocate," while Eric Trump, Donald Trump Jr., and Barron Trump each hold "Web3 Ambassador" titles.

The platform's mission is to bridge regulated banking and permissioned DeFi, aiming for institutional adoption while democratizing access to capital. Unlike traditional DeFi projects that emerged from anonymous teams, WLFI openly leverages its political connections to pursue regulatory integration and institutional partnerships.

The Hybrid Finance Model

World Liberty Financial operates as "hybrid finance" infrastructure, combining:

Traditional Banking Elements:

- Pursuit of federal banking charter through the OCC

- Cash and U.S. Treasury reserves backing

- Institutional-grade custody through BitGo Trust Company

- Compliance-first approach to regulation

Decentralized Finance Components:

- Built on Ethereum and BNB Chain

- Utilizes proven Aave V3 lending protocol

- Token-based governance through WLFI

- Permissionless participation in core services

This hybrid approach differentiates WLFI from both traditional banks (which lack blockchain efficiency) and pure DeFi protocols (which often struggle with regulatory compliance).

USD1 Stablecoin: The Fastest Growing Digital Dollar

USD1 is World Liberty Financial's flagship stablecoin and has achieved unprecedented growth since its March 2025 launch. The stablecoin reached $2 billion in circulation within 90 days—a milestone that took leading stablecoin USDT four years to achieve.

USD1 Technical Specifications

Backing and Reserves:

- 1:1 peg to U.S. dollar

- Reserves held in cash and short-term U.S. Treasuries

- BitGo Trust Company serves as regulated custodian

- Transparent reserve attestation (positioning as "most regulated stablecoin")

Network Availability:

- Ethereum (primary)

- BNB Chain

- Future multi-chain expansion planned

Exchange Integration:

USD1 is available on major centralized exchanges including:

- Coinbase

- Kraken

- Binance

- KuCoin

- MEXC

- HTX

- Gate.io

Record-Breaking Adoption

As of January 2026, USD1 has reached $4.93 billion in circulating supply, making it one of the fastest-growing stablecoins in history. This growth has been fueled by:

- Institutional Capital Deployment: The $2 billion MGX investment using USD1 to acquire a Binance stake demonstrated institutional confidence

- Exchange Partnerships: Integration with major platforms like MoonPay for fiat on-ramps

- DeFi Utility Expansion: Launch of World Liberty Markets and third-party integrations

- Cross-Border Adoption: Pakistan partnership exploring USD1 for international payments

Donald Trump Jr. has stated the goal is to make USD1 "the most transparent, the most regulated, stablecoin in the world."

USD1 Revenue Model

World Liberty Financial generates revenue from USD1 through:

- Investment Returns: Earning yield on Treasury securities backing the stablecoin (approximately $80 million annually as of 2025)

- Transaction Fees: Fees from USD1 transfers and conversions

- Ecosystem Integration: Partnership arrangements with platforms utilizing USD1

The Trump family receives 75% of net proceeds from token sales and a portion of stablecoin profits, according to the project's structure.

WLFI Governance Token: Ecosystem Participation

The WLFI token serves as the ecosystem's governance instrument, enabling holders to vote on protocol proposals, strategic decisions, and ecosystem expansion.

Token Economics and Distribution

Total Supply: 100 billion WLFI tokens

Distribution Structure:

- 70% held by project insiders and founders

- 22.5 billion units allocated to Trump family and affiliates

- 30% available for public sale

Market Performance:

- Market cap: $3.56 billion (as of October 2025)

- Ranking: 43rd largest cryptocurrency

- Exchange availability: Binance, Coinbase, OKX, major platforms

Token Generation Event and Trading Launch

WLFI's token generation event occurred on September 1, 2025, following months of preparation:

August 2025 Milestones:

- Lockbox Activation (August 25): Enabled presale participants to begin unlock process for initial 20% allocation

- Exchange Confirmations: Huobi, Kraken, KuCoin, HTX, and MEXC confirmed support

- Promotional Campaigns: MEXC launched 880,000 WLFI giveaway via Launchpad

Strategic Capital Raise:

The $1.5 billion ALT5 Sigma capital raise in August 2025 integrated 7.78% of total WLFI supply into ALT5's corporate treasury. This arrangement embedded WLFI leadership into ALT5's governance:

- Zach Witkoff: Chairman of ALT5's board

- Eric Trump: ALT5 board member

This partnership provided WLFI with validation through an SEC-regulated public company holding substantial treasury positions—creating institutional legitimacy uncommon in cryptocurrency.

Governance Rights and Mechanisms

WLFI token holders participate in ecosystem governance through:

Voting Categories:

- Protocol Upgrades: Technical changes, security improvements, infrastructure decisions

- Strategic Decisions: Ecosystem expansion, partnership approvals, treasury management

Governance Safeguards:

- No single wallet or affiliated group can vote with more than 5% of total supply

- Community participation in major decisions

- Transparent proposal and voting mechanisms

Note on Transferability:

Original governance tokens distributed by the protocol are non-transferable, though exchange-traded WLFI tokens maintain liquidity. This design aims to align long-term governance participation while enabling market access through exchanges.

Recent WLFI Developments (2026)

Robinhood Integration (January 2026):

WLFI was activated on Robinhood, significantly expanding retail accessibility in the United States.

Lista DAO Lending Markets:

WLFI became available as collateral in Lista DAO lending platforms, expanding DeFi utility.

Project Wings:

Collaborative effort with Solana cultural icon BONK to expand USD1 usage on Solana blockchain.

World Liberty Markets: The First DeFi Application

World Liberty Financial launched its first web application, World Liberty Markets, on January 12, 2026, marking a major expansion of USD1 utility through lending and borrowing services.

Platform Features

Supported Assets:

- USD1 (World Liberty Financial stablecoin)

- WLFI (governance token)

- Ether (ETH)

- Coinbase Wrapped Bitcoin (cbBTC)

- USDC

- USDT

Core Functionality:

- Supply Assets: Deposit supported tokens as collateral to earn yield

- Borrow Against Collateral: Access liquidity while maintaining asset exposure

- Yield Optimization: Deploy borrowed capital into additional strategies

Technical Infrastructure:

Built on Dolomite's proven DeFi protocol, World Liberty Markets leverages battle-tested infrastructure for:

- Secure lending and borrowing

- Collateralized positions management

- Automated liquidation mechanisms

- Risk-managed yield generation

USD1 Points Program

World Liberty Markets integrates the USD1 Points Program, rewarding users who supply USD1:

Program Mechanics:

- Eligible users earn points based on USD1 supply activity

- Points track participation across the ecosystem

- May support future program features as ecosystem expands

- Points are reward metrics, not tokens or financial returns

Multi-Platform Recognition:

Users can earn USD1 Points across partner platforms supporting USD1 activity, with availability and rules determined by each partner's terms.

Zak Folkman on World Liberty Markets

"A year ago, we set out to build a stablecoin that could compete with the biggest names in crypto, and USD1 has exceeded every expectation. Now we're giving USD1 users access to even more ways to put their stablecoins to work. World Liberty Markets is a major step forward, and it's just the first of many products we're planning to roll out over the next 18 months."

World Liberty Financial Ecosystem Projects

World Liberty Financial has cultivated a growing ecosystem of partner projects and integrations that expand USD1 utility and drive adoption across DeFi.

Leading Ecosystem Projects

Lorenzo Protocol:

Lorenzo Protocol launched sUSD1+ OTF, the first-ever yield product for USD1 holders. This institutional-grade tokenized fund transforms USD1 from a transactional currency into a wealth-building instrument through:

- Diversified yield strategies across DeFi, CeFi, and tokenized real-world assets

- Sustainable, risk-managed return profiles

- Enhanced USD1 market depth through trading activity

Lorenzo's sUSD1+ represents a critical milestone in USD1's evolution, enabling holders to earn competitive yields while strengthening the broader WLFI ecosystem's liquidity foundation.

Lista DAO:

Decentralized lending protocol that integrated WLFI as collateral, enabling users to borrow against their governance token holdings while maintaining voting rights.

PancakeSwap:

In June 2025, World Liberty Financial formed a joint initiative with PancakeSwap (operated by Binance) to promote USD1 adoption:

- "Liquidity Drive" program offering prizes up to $1 million

- Deep liquidity pools for USD1 trading

- Integration across Binance ecosystem

Plume:

Tokenized real-world asset platform integrating USD1 as a settlement layer for traditional asset transactions on-chain.

1/ sUSD1+ is LIVE on @Plumenetwork Mainnet!

— Lorenzo Protocol (@LorenzoProtocol) January 15, 2026

Users can now mint and redeem sUSD1+ directly on Plume using USD1 and USDC, with bridging supported by @Chainlink CCIP to enable seamless cross-network access.

As a leading RWA blockchain, Plume provides a strong foundation for sUSD1+… pic.twitter.com/diGXuRrOA9

Dolomite:

Powers the World Liberty Markets lending infrastructure, providing proven DeFi technology for secure borrowing and lending.

Major Exchange Partners:

Coinbase, Binance, Kraken, and other tier-1 exchanges provide critical liquidity and accessibility for both USD1 and WLFI tokens.

Ecosystem Growth Initiatives

Project Wings (BONK Partnership):

Collaboration with Solana's cultural icon BONK to expand USD1 usage on Solana blockchain, bringing the stablecoin to one of crypto's most active ecosystems.

Memecoin Integration:

Hundreds of patriotic-themed memecoins (Torch of Liberty, Eagles Landing, etc.) created to promote USD1 adoption, primarily by international users seeking exposure to the WLFI ecosystem.

International Partnerships:

Pakistan signed an agreement with SC Financial Technologies (affiliated with WLFI) to explore USD1 for cross-border payments—one of the first public collaborations between WLFI and a sovereign nation.

World Liberty Financial's Institutional Strategy

WLFI has pursued an explicitly institutional path, differentiating from retail-focused DeFi projects through regulatory compliance and high-profile partnerships.

National Trust Banking Charter Application

In January 2026, World Liberty Trust (owned by WLF, with Zach Witkoff as president and chairman) applied for a national banking license with the U.S. Office of the Comptroller of the Currency (OCC).

Charter Implications:

- Federal oversight of USD1 issuance and custody

- Regulatory legitimacy uncommon for stablecoins

- Potential competitive advantage over unregulated alternatives

- Enhanced institutional confidence

If approved, this would place World Liberty Financial under direct federal banking regulation—unprecedented for a DeFi-native project.

Major Institutional Transactions

MGX Investment ($2 Billion - May 2025):

Abu Dhabi-backed sovereign wealth fund MGX, led by UAE National Security Advisor Tahnoun bin Zayed Al Nahyan, used $2 billion worth of USD1 stablecoin to finance a minority stake acquisition in Binance.

This transaction demonstrated:

- Institutional confidence in USD1 as settlement currency

- Sovereign-level adoption for major financial transactions

- WLFI's positioning at intersection of crypto and geopolitics

Justin Sun Partnership:

Justin Sun, founder of Tron blockchain, acquired at least $75 million in WLFI tokens and was named a World Liberty Financial advisor. WLFI subsequently integrated USD1 into Tron's blockchain infrastructure.

ALT5 Sigma Capital Raise ($1.5 Billion):

Public company ALT5 integrated 7.78% of WLFI supply into its treasury while embedding WLFI leadership in its governance structure.

World Liberty Forum: Building Institutional Networks

On January 20, 2026, Donald Trump Jr. announced the World Liberty Forum—an invitation-only event at Mar-a-Lago for 300 global leaders from finance, sports, and government.

Confirmed Speakers:

- David Solomon (Chairman & CEO, Goldman Sachs)

- Gianni Infantino (President, FIFA)

- Jacob Helberg (U.S. Under Secretary for Economic Affairs)

The forum represents WLFI's strategy of building institutional relationships at the highest levels of global finance and government.

Technical Architecture and Security

World Liberty Financial leverages proven blockchain infrastructure rather than building entirely new systems, prioritizing security and reliability over novelty.

Aave V3 Integration

WLFI is built on Aave V3, the battle-tested lending protocol handling over $40 billion in total value locked across DeFi.

Partnership Structure:

- Aave DAO receives 7% of WLFI token supply

- Aave DAO receives 20% of future fees generated by WLFI platform

- WLFI gains access to proven security infrastructure

- Users benefit from Aave's extensive audit history

Technical Benefits:

- Established liquidation mechanisms

- Risk management systems

- Multi-year security track record

- Active developer community

Multi-Chain Infrastructure

Current Networks:

- Ethereum (primary)

- Binance Smart Chain

- Tron (through Justin Sun partnership)

- Solana

- AB Core

- Aptos

- Mantle

- Monad

- Morph

- Plume

Planned Expansion:

WLFI has indicated plans for additional blockchain integrations to maximize accessibility and liquidity across the crypto ecosystem.

Security Audits and Custody

Reserve Custody:

BitGo Trust Company provides institutional-grade custody for USD1 reserves, meeting regulatory standards for traditional financial institutions.

Smart Contract Security:

Leverages Aave V3's extensive audit coverage, including:

- Multiple independent security audits

- Ongoing bug bounty programs

- Active security monitoring

- Proven track record across billions in transactions

Regulatory Landscape and Compliance

World Liberty Financial operates at the intersection of cryptocurrency innovation and traditional financial regulation, creating both opportunities and challenges.

Current Regulatory Status

SEC and CFTC Oversight:

WLFI has attracted attention from U.S. regulators due to its high-profile political connections and significant capital flows. The concentration of ownership and token structure could lead to classification as a security under U.S. law.

International Implications:

The project's success or failure could influence how other nations approach cryptocurrency regulation and the role of political figures in blockchain projects.

Compliance Strategy

WLFI's approach to regulation includes:

- Pursuit of Federal Banking Charter: Proactive engagement with OCC for national trust license

- Transparent Reserve Backing: Cash and Treasury reserves with regulated custodian

- Exchange Compliance: Listings on regulated platforms like Coinbase and Kraken

- Institutional Partnerships: Alignment with traditional finance entities

Political Connections and Controversy

The Trump family's involvement has generated extensive reporting on potential conflicts of interest:

Ownership Structure:

- Trump business entity owns 60% of World Liberty Financial

- Entitled to 75% of revenue from coin sales

- Trump family holdings valued at $6+ billion at peak

Political Concerns:

Democratic lawmakers, including Senator Elizabeth Warren, have criticized:

- Potential conflicts during Donald Trump's presidency

- Foreign entity investments (Justin Sun, MGX)

- Lack of transparency in some arrangements

Trump Administration Response:

Donald Trump has repeatedly stated he "hasn't looked" at the profits, attempting to distance from conflict of interest concerns. Donald Trump officially stepped back to "co-founder emeritus" status upon taking presidential office in January 2025.

Product Roadmap and Future Development

World Liberty Financial has outlined an ambitious expansion plan beyond basic lending and borrowing services.

Near-Term Priorities (2026)

Credit Card Integration:

Crypto-backed credit cards enabling USD1 spending in traditional retail environments, bridging digital assets with everyday commerce.

Real-World Asset Tokenization:

Bringing traditional assets (real estate, commodities, securities) onto blockchain infrastructure using USD1 as settlement currency.

Enhanced Mobile Experience:

Comprehensive mobile application for DeFi access, currently focused on web platform.

Cross-Chain Expansion:

Additional blockchain network integrations to maximize reach and liquidity.

Long-Term Vision

World Liberty Financial positions itself as infrastructure for the "internet of money"—the financial industry's next operating system where:

- Traditional assets are tokenized and traded 24/7

- Cross-border payments happen instantly with minimal fees

- Financial services are accessible globally without permission

- Compliance and transparency are built into infrastructure

The team has indicated plans to roll out multiple new products over the next 18 months, with each designed to expand USD1 utility and WLFI ecosystem adoption.

Risks and Considerations

Potential users and investors should carefully evaluate several unique risks associated with World Liberty Financial.

Regulatory Risk

WLFI's political connections create unprecedented regulatory exposure:

- Changes in political climate could impact operations

- High profile makes it likely target for regulatory action

- Precedents set by WLFI actions could affect broader DeFi

- International implications of U.S. political involvement

Centralization Concerns

Despite DeFi marketing, WLFI incorporates significant centralized elements:

- Concentration of token ownership (70% insiders)

- Political family control

- Ability to freeze user funds (typical of custodial arrangements)

- Administrative actions could affect holdings

Market and Liquidity Risk

For WLFI Token:

- Original governance tokens are non-transferable

- Must rely on protocol mechanisms for value realization

- Exchange-traded tokens provide liquidity but may differ from governance tokens

For USD1:

- Dependent on reserve backing and custodian solvency

- Regulatory action could affect redemption ability

- Competition from established stablecoins (USDT, USDC)

Smart Contract Risk

While leveraging Aave's proven infrastructure reduces risk:

- All DeFi protocols face potential exploits

- Integration bugs could create vulnerabilities

- User error in complex DeFi operations

Political Risk

Unique to WLFI due to Trump family involvement:

- Political controversies could affect adoption

- Foreign policy changes might impact international partnerships

- Potential alienation of users preferring politically neutral infrastructure

Conclusion: World Liberty Financial's Position in 2026

World Liberty Financial represents a unique experiment at the intersection of political influence, institutional finance, and blockchain technology. Within two years, the project has achieved remarkable milestones:

- USD1 became the fastest-growing stablecoin in history ($4.93 billion)

- WLFI token ranks among the top 50 cryptocurrencies

- Sovereign wealth funds and public companies invested billions

- Applied for federal banking charter

- Launched functional DeFi applications

- Built growing ecosystem of partner projects

The platform's explicit hybrid approach—combining regulatory compliance with blockchain efficiency—differentiates it from both traditional finance and pure DeFi alternatives. Whether this strategy succeeds in bridging two historically separate worlds remains to be determined.

For the broader cryptocurrency ecosystem, WLFI serves as a test case for:

- Political involvement in DeFi projects

- Regulatory pathways for stablecoin issuers

- Institutional adoption of blockchain infrastructure

- Balance between decentralization ideals and practical governance

As World Liberty Financial continues expanding through 2026 and beyond, its trajectory will influence how institutions, regulators, and users approach the convergence of traditional finance and decentralized technology. The ultimate success will depend on navigating regulatory challenges, maintaining user trust, delivering on promised infrastructure, and managing the unique complexities of operating at the intersection of politics and cryptocurrency.

Frequently Asked Questions

What is World Liberty Financial?

World Liberty Financial is a hybrid DeFi protocol that bridges traditional banking and blockchain technology. Founded in 2024 with backing from the Trump family, it operates a lending and borrowing platform built on Aave V3, anchored by the USD1 stablecoin and WLFI governance token. The project pursues institutional adoption through regulatory compliance and high-profile partnerships.

How can I earn yield on my USD1 holdings?

There are two primary ways to earn yield on USD1:

World Liberty Markets (Official Platform):

Launched January 2026, this is WLFI's native lending platform where you can:

- Supply USD1 to earn interest from borrowers

- Participate in the USD1 Points Program

- Access integrated DeFi services through Dolomite infrastructure

Lorenzo Protocol's sUSD1+ OTF:

As the first-ever third-party USD1 yield product, Lorenzo Protocol's sUSD1+ represents the pioneering effort to transform USD1 from a transactional stablecoin into a wealth-building instrument with competitive yields. It offers:

Triple Yield Engine

Combines tokenized RWAs, quantitative trading, and DeFi strategies.

sUSD1+ Token

sUSD1+ token is a non-rebasing, yield-bearing token representing fund shares. The redemption value increases over time, while the token balance remains constant.

Fully On-Chain & USD1-Settled

USD1+ OTF is built for DeFi composability with seamless on-chain execution and redemptions settled exclusively in USD1.

Accessible & Secure

Subscribe with ≥ 50 USD1, USDT, or USDC. All assets are deployed through professionally managed strategies with institutional-grade infrastructure and secure custody.

Is World Liberty Financial safe?

WLFI incorporates multiple security measures:

- Built on battle-tested Aave V3 protocol ($40+ billion TVL)

- BitGo Trust Company provides regulated custody

- USD1 backed by cash and U.S. Treasuries

- Pursuing federal banking charter for additional oversight

However, risks include:

- Regulatory uncertainty due to political connections

- Centralization elements contradicting pure DeFi principles

- Smart contract risks inherent in all DeFi

- Relatively short track record compared to established stablecoins

Users should conduct thorough due diligence and only invest what they can afford to lose.

What makes USD1 different from USDC or USDT?

USD1 differentiates through:

Political Backing:

Direct association with Trump family provides unique profile and institutional attention.

Regulatory Pursuit:

Active application for national trust banking charter seeks federal oversight beyond typical stablecoin regulation.

Growth Velocity:

Reached $2 billion circulation in 90 days versus 4 years for USDT—fastest-growing digital dollar in history.

Institutional Integration:

Used in major transactions like MGX's $2 billion Binance investment and Pakistan cross-border payment exploration.

Expanding Utility:

Integrated ecosystem including World Liberty Markets, Lorenzo Protocol's sUSD1+, and growing DeFi partnerships.

However, USDC and USDT maintain significant advantages in:

- Longer track records and established trust

- Broader exchange and DeFi integration

- Larger market capitalization and liquidity

- Less regulatory uncertainty

Can I trade WLFI tokens?

Yes and no—there are two types of WLFI tokens:

Exchange-Traded WLFI:

Available on major platforms including:

- Binance

- Coinbase

- OKX

- Kraken

- Other major exchanges

These tokens can be freely bought, sold, and traded.

Original Governance Tokens:

Distributed directly by the protocol are non-transferable. Holders retain governance rights but cannot sell on secondary markets.

This dual structure aims to balance long-term governance participation with market accessibility.

Who controls World Liberty Financial?

Ownership and control structure:

Trump Family:

- Owns 60% through Trump business entity

- Receives 75% of revenue from token sales

- Holds 22.5 billion WLFI tokens

- Eric Trump and Donald Trump Jr. actively manage

Operational Team:

- Zachary Folkman (Co-Founder, COO)

- Chase Herro (Co-Founder)

- Zach Witkoff (Co-Founder, President of World Liberty Trust)

- Alex Witkoff (Co-Founder)

Governance:

- WLFI token holders vote on protocol decisions

- No single entity can vote with more than 5% of supply

- Distinction between ownership (Trump family majority) and governance (token holder participation)

What is World Liberty Financial's relationship with Aave?

WLFI is built on Aave V3's lending protocol infrastructure:

Partnership Terms:

- Aave DAO receives 7% of WLFI token supply

- Aave DAO receives 20% of platform fees

- WLFI gains access to proven security infrastructure

- Integration represents one of DeFi's largest institutional partnerships

Technical Integration:

World Liberty Markets uses Aave's battle-tested code for:

- Lending and borrowing mechanisms

- Liquidation systems

- Risk management

- Security audits and monitoring

This allows WLFI to focus on user experience and ecosystem growth while leveraging Aave's technical excellence.

Can international users access World Liberty Financial?

Availability varies by jurisdiction:

USD1 Stablecoin:

- Available on international exchanges (Binance, KuCoin, etc.)

- Integrated into multiple blockchains (Ethereum, BNB Chain, Tron)

- Used in cross-border transactions (Pakistan partnership)

World Liberty Markets:

- May have restrictions based on local regulations

- Users should verify compliance with their jurisdiction

- KYC/AML requirements likely apply

WLFI Token:

- Traded on major global exchanges

- Subject to local cryptocurrency regulations

- Some jurisdictions may restrict access

International users should consult local regulations before participating in WLFI ecosystem.

What happened with the MGX and Binance deal?

In May 2025, MGX (Abu Dhabi-backed sovereign wealth fund) used $2 billion worth of USD1 to finance a minority stake acquisition in Binance.

Transaction Details:

- Led by Tahnoun bin Zayed Al Nahyan (UAE National Security Advisor)

- Largest known institutional transaction using USD1

- Demonstrated sovereign-level confidence in the stablecoin

Controversy:

- Critics raised conflict of interest concerns

- Transaction occurred during Trump presidency

- Binance founder Changpeng Zhao later received presidential pardon

- Reuters reported WLFI co-founders met with CZ in Abu Dhabi

The deal highlighted both USD1's institutional acceptance and the political complexities of Trump family involvement in cryptocurrency.

How does World Liberty Financial compare to traditional banks?

WLFI combines elements of both:

Traditional Banking Aspects:

- Pursuing federal banking charter

- Regulated reserve custody (BitGo)

- Cash and Treasury backing

- Institutional focus

Blockchain Advantages:

- 24/7 operation

- Global accessibility

- Faster settlement times

- Lower overhead costs

- Programmable infrastructure

Key Differences:

- No deposit insurance (FDIC) for USD1 holders

- Higher technical complexity for users

- Regulatory status still evolving

- Political connections uncommon for banks

WLFI aims to bridge these worlds, offering blockchain efficiency with traditional financial legitimacy.

What is the World Liberty Forum?

Announced January 20, 2026, the World Liberty Forum is an invitation-only event at Mar-a-Lago bringing together 300 global leaders from finance, sports, and government.

Purpose:

Facilitate conversations about the future of finance and technology without set scripts or talking points.

Notable Speakers:

- David Solomon (Goldman Sachs CEO)

- Gianni Infantino (FIFA President)

- Jacob Helberg (U.S. Under Secretary for Economic Affairs)

Hosted By:

WLFI co-founders Eric Trump, Donald Trump Jr., Zach Witkoff, and Alex Witkoff.

The forum represents WLFI's institutional networking strategy at the intersection of politics, finance, and technology.

Disclaimer

This content is published for informational and research purposes only. Any discussion of projects, tokens, or protocols is intended to illustrate broader market trends and does not constitute financial, investment, or legal advice. References to third-party projects are not endorsements, partnerships, or affiliations with Lorenzo Protocol.

Readers should conduct their own due diligence and exercise caution when engaging with any project or platform mentioned. Lorenzo Protocol makes no representations or warranties regarding the accuracy, completeness, or reliability of information contained herein, and assumes no liability for any losses or damages arising from its use.