Tokenized Financial Products: How Fintech Can Offer Real Crypto Yield

How tokenized financial products enable wallets, neobanks, and PayFi apps to turn idle crypto balances into real yield.

In the early days of DeFi, yield was abundant—until it wasn’t.

During DeFi Summer in 2020, protocols like Compound and Yearn Finance pioneered liquidity mining and vault strategies, sending Ethereum-based DeFi into hypergrowth. Total value locked (TVL) on Ethereum surged from under $1 billion in June to over $13 billion by December, and native tokens like YFI, UNI, and SUSHI captured mainstream attention.

But this growth was powered largely by short-term incentives: token emissions, airdrops, and yield farming loops. When incentives ran dry and copycat protocols saturated the market, capital fled. Token prices collapsed, yields cratered, and volatility rippled across ecosystems.

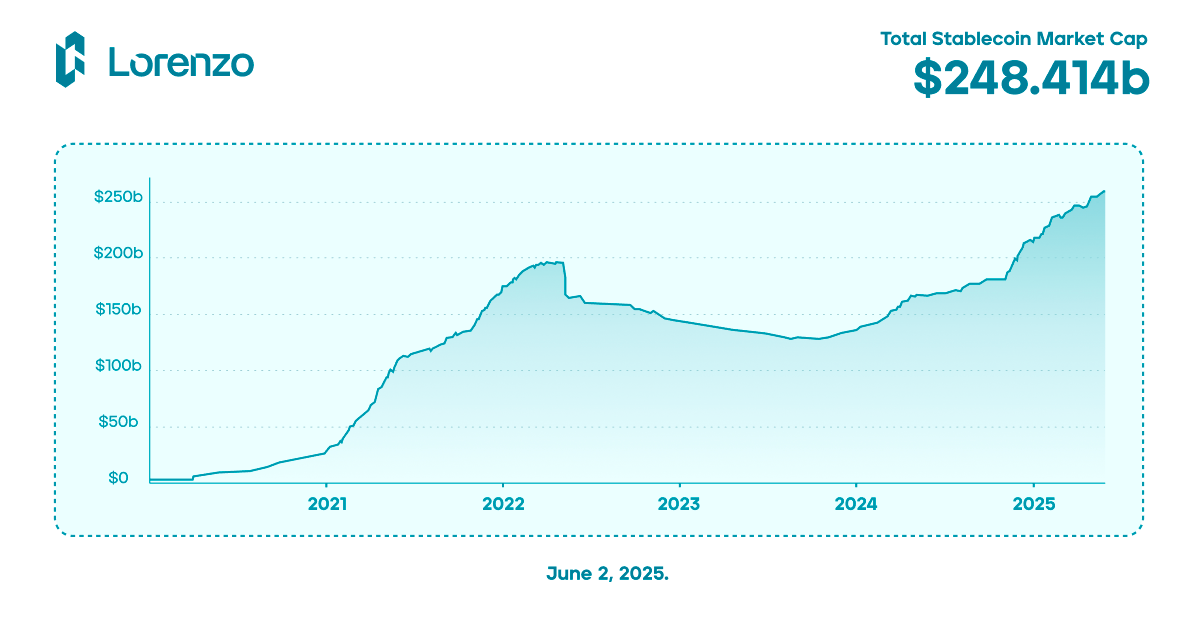

Today, we face a new environment. Stablecoins have already facilitated over $3 trillion in total transaction volume in 2025. Institutional adoption is climbing, wallets and PayFi apps are scaling rapidly, and the market cap of stablecoins has grown to over $240 billion from $160 billion twelve months ago.

However, much of the capital now sits idle in wallets, neobanks, exchanges, and card platforms, earning little or no yield. What’s missing is a modular, compliant backend infrastructure that can deploy idle balances into real, risk-adjusted financial products.

These products—“tokenized financial products”—offer a new path forward to closing the gap. They make real yield composable, programmable, and accessible. In this article, we’ll cover the essentials crypto investors need to understand, explain why fintech firms are adopting these products, and show how Lorenzo Protocol makes it possible to launch them without building asset management infrastructure from scratch.

What Are Tokenized Financial Products?

Tokenized financial products are on-chain financial instruments, backed by either singular or bundled yield strategies, purchasable via transferable tokens. Each product is engineered to deliver targeted outcomes, such as fixed yield or downside protection, and can be issued via smart contracts for integration into wallets, exchanges, and fintech apps.

Unlike traditional DeFi yield farming or liquid staking tokens, these products are not dependent on inflationary incentives. They are constructed using real strategies—staking, arbitrage, RWA financing, and CeFi trading—subject to predefined risk and return constraints.

Product Type Examples

Fixed Yield ProductsOffer a predefined return over a fixed term, typically using low-volatility CeFi or RWA-backed strategies.Example: 6% APY generated by lending stablecoins to a prime broker with collateral protection.

Principal-Protected ProductsGuarantee the return of principal while allocating a small portion of funds to higher-risk strategies.Example: 90% of capital goes into staking, while 10% is deployed into a managed trading strategy.

Dynamic Leverage ProductsUse automated rebalancing or human management to dynamically increase or reduce exposure based on volatility or market trends.Example: A vault rotates between ETH staking and volatility arbitrage depending on risk appetite.

Multi-Strategy PortfoliosAggregate multiple vaults into a rebalanced portfolio to diversify exposure and smooth yield outcomes.Example: A multi-strategy vault combining BTC staking, RWA lending, and delta-neutral trading.

Why Fintech and Web3 Platforms Need These Products

Today’s idle stablecoin capital inefficiency problem limits both platforms and users.

Wallets, neobanks, PayFi apps, and card issuers are increasingly responsible for overall on-chain capital flow, but they lack the backend systems to optimize balances for financial outcomes.

Tokenized financial products help solve this gap by providing:

- Capital Efficiency Without Complexity: Platforms can deploy idle balances into pre-structured products.

- Risk-Managed, Plug-and-Play Yield: Strategies are designed with clear risk profiles and are integrated via modular APIs.

- Differentiation at the Application Layer: Yield becomes a feature embedded directly into the user experience, enhancing retention and monetization.

Use Cases Across the Fintech Stack

Consumer Wallets and Payment Apps

Apps like Revolut, Cash App, and PayPal offer crypto wallets. By integrating tokenized yield vaults, these platforms can offer embedded yield on held balances without taking on execution risk or launching proprietary yield products.Example: Cash App routes $100 million in idle USDC into a fixed yield vault earning 6% APY, distributing 4% to users and retaining 2% as net interest margin.

Neobanks and Challenger Banks

Platforms like Juno, Wirex, and Monzo can offer yield-bearing stablecoin accounts by plugging into principal-protected or fixed-yield vaults. These integrations turn balance sheets into monetizable assets without requiring asset management infrastructure.Example: Juno could embed a principal-protected vault offering 5% on USDC savings, enhancing user retention and ARPU.

Crypto-Facing Fintechs and RWA Marketplaces

Companies like Stripe, Reap, and Bitso manage crypto and stablecoin flows but rarely generate yield from float. With tokenized financial products, they can deploy idle capital into safe, short-duration vaults or offer branded savings products to users.Example: Bitso could use a vault to diversify remittance reserves across staking, lending, and tokenized Treasuries, generating 5% net yield on pre-funded liquidity.

Embedded Finance Providers

API-first fintechs like Unit, Treasury Prime, and Synapse can integrate tokenized vaults to enable their clients, whether banks or consumer apps, to embed yield functionality directly into accounts or virtual cards.Example: A neobank built on Unit could offer a branded 4.5% APY savings product powered by fixed income vaults, eliminating the need to underwrite yield strategies internally.

Lorenzo Protocol’s Approach

Tokenized financial products represent the convergence of two defining trends: the rise of programmable money and the increasing need for capital efficiency across fintech and Web3 platforms.

For forward-looking fintech teams, real yield can no longer be treated as an incentive layer or short-term differentiator. It must be embedded into the core product experience. Tokenized financial products—and the infrastructure that powers them—make that possible.

Functioning as the backend infrastructure powering the launch, maintenance, and scaling of tokenized financial products, Lorenzo Protocol, through its core infrastructure, the Financial Abstraction Layer (FAL), enables fintech platforms to offer structured yield products without having to build or manage complex asset infrastructure.

Partners retain full control of branding, UX, and user engagement, while Lorenzo handles product creation and optimization, asset management (through leading institutional-grade custody services), and payout to users, while providing reporting APIs and yield and risk management operational support.

Built for scalability, safety, and seamless integration, Lorenzo empowers fintechs to unlock real yield, differentiate product offerings, and generate margin from capital that would otherwise sit idle.

→ Ready to launch tokenized financial products? Visit lorenzo-protocol.xyz or reach out to our team to get started.